For foreign investors, understanding the UAE’s business environment requires a clear understanding of the incentives available, from tax exemptions to full ownership options in free zones and streamlined processes for obtaining visas and work permits. These incentives are not only financial but also procedural, significantly reducing the complexities that traditionally come with establishing a business in a foreign country.

Additionally, UAE policymakers have actively adjusted these incentives to meet the evolving needs of investors, allowing for greater flexibility and security in a region known for fluctuating market dynamics.

Tax advantages

The UAE offers highly favourable tax advantages that attract global investors and businesses by minimizing tax burdens and promoting a business-friendly environment. These incentives, combined with the UAE's strategic location and world-class infrastructure, position the country as a prime choice for businesses looking to maximize profitability.

Zero Personal Income Tax and Low Corporate Tax Rates

One of the most appealing aspects of the UAE's tax system is the absence of personal income tax, allowing individuals and business owners to retain the entirety of their earned income without deductions. For corporations, the UAE introduced a corporate tax rate of 9 percent in 2023, which is low compared to many other countries. This corporate tax applies only to companies generating profits over AED 375,000 (USD 102,000), with exemptions for certain types of income and industries.

Corporate tax on free zone entities

Entities established in Designated and Qualified Free Zones may qualify as Qualifying Free Zone Persons (QFZPs) if they:

- Deriving qualifying income from activities specified in the CT Law.

- Registered in the qualified Free Zone;

- Maintaining adequate substance in the UAE.

- Complying with transfer pricing (TP) rules and documentation requirements.

- Meet the rule of minimum income from the mainland (de minimis rule).

- Preparing audited financial statements.

QFZPs benefit from a 0 percent CT rate during the tax incentive period, provided they comply with the relevant conditions.

The Ministry stated that an administrative penalty of AED 10,000 for late registration of UAE Corporate Tax will be imposed on businesses that do not submit their Corporate Tax registration applications within the timelines specified by the Federal Tax Authority.

The penalty was introduced to encourage taxpayers’ compliance with tax regulations by registering for corporate tax in a timely fashion. The penalty amount for late tax registration is aligned with the penalty associated with late registration for excise tax and value-added tax.

Exemptions

Certain entities are exempt from corporate tax, including:

- Government entities (automatically exempt).

- Extractive and non-extractive natural resource businesses that notify the Ministry of Finance (MoF).

- Government-controlled entities and qualifying public benefit entities listed in a Cabinet Decision (CD).

- Juridical persons wholly owned by exempt entities and those approved by the Federal Tax Authority (FTA).

No Capital Gains Tax and Full Profit Repatriation

A major attraction for foreign investors is the UAE’s lack of capital gains tax, allowing investors to reinvest profits without the tax burdens commonly associated with capital gains. This is particularly advantageous for individuals and entities with substantial investment portfolios, as gains from asset sales, including property, stocks, and other capital investments, remain untaxed.

Additionally, the UAE allows foreign investors to repatriate 100 percent of their profits and capital without restrictions. This flexibility facilitates financial planning and global operations by removing common limitations on the movement of funds back to the investor's home country.

Additional tax benefits and foreign tax credit

Beyond its favourable domestic tax policies, the UAE also offers mechanisms to prevent double taxation for international businesses. Businesses and individuals can obtain a Tax Residency Certificate from the Federal Tax Authority, making them eligible for foreign tax credits. These credits are available for taxes paid abroad on UAE-sourced income, further ensuring that income generated in the Emirates is not subject to dual taxation.

However, it is important to note that foreign tax credits are limited to the UAE corporate tax amount on the income in question, and any unutilized credits cannot be carried forward.

Small business relief

For smaller businesses, the UAE offers tax relief under the "Small Business Relief" policy. Companies with revenue below AED 3 million (USD 816,882) can choose to exempt their income from corporate tax if they meet the eligibility requirements.

This exemption is available until December 2026 and excludes certain tax provisions, making it an attractive option for startups and growing enterprises.

Tax grouping

A group of UAE tax resident companies may choose to form a tax group, which allows them to be treated as a single taxable entity, provided they meet the following conditions:

- The parent company must hold at least 95 percent (either directly or indirectly) of the subsidiary's share capital, voting rights, profits, and net assets.

- Both the parent company and the subsidiary must share the same financial year and use the same accounting standards for preparing their financial statements.

- Neither the parent company nor the subsidiary can be classified as an Exempt Person or a Qualifying Free Zone Person, which would otherwise qualify for the 0 percent UAE corporate tax rate.

The tax group is required to prepare consolidated financial statements in line with the accounting standards applicable in the UAE. The parent company will consolidate the financial results, assets, and liabilities of each subsidiary during the relevant tax period, ensuring that any intercompany transactions are eliminated.

R&D and talent incentives

The UAE plans to introduce corporate tax incentives to boost growth, innovation, and high-value employment. R&D Tax Incentive (Effective January 1, 2026) offers a refundable tax credit of 30-50 percent for businesses conducting eligible R&D activities.

High-Value Employment Incentive (Effective January 1, 2025) provides a tax credit based on eligible salary costs for businesses employing senior professionals in key roles.

Business ownership and structure

100 percent foreign ownership

In June 2021, the UAE enacted pivotal changes to the Commercial Companies Law, allowing foreign investors full ownership of their businesses in most sectors in mainland. This policy shift removed the previous requirement of having a UAE national sponsor for business ownership, granting foreigners the ability to fully own the capital in locally registered companies in mainland. More than 1,000 business activities—including agriculture, healthcare, education, construction, hospitality, arts, and technical services—are now eligible for 100 percent foreign ownership. This ownership structure is available outside the UAE’s free zones as well, providing a broader range of investment opportunities without local partnership restrictions.

For investors seeking additional tax and administrative advantages, establishing a business within one of the UAE’s free zones remains a viable option. Free zones across the UAE allow foreign nationals to own 100 percent of their company shares, often accompanied by zero corporate tax incentives, simplified registration processes, and modern infrastructure tailored to various industries.

Flexible business structures

The UAE’s flexible approach to business structures offers investors a range of legal frameworks to suit different operational and strategic needs. Companies can choose from multiple legal forms, including Limited Liability Companies (LLCs), partnerships, joint ventures, and free zone entities. Each of these structures provides distinct benefits, allowing businesses to align with their scale, sector, and ownership preferences.

One of the more popular structures, the Limited Liability Company (LLC), is open to both foreign and local investors and provides a protective layer between business assets and personal assets. LLCs require at least one shareholder but can be formed with up to 50 shareholders, making them highly adaptable for small to large businesses.

Additionally, free zone companies allow for a streamlined setup process with distinct tax incentives and lower administrative requirements, particularly for companies focused on trade, services, or manufacturing. These entities also benefit from customs and import tax exemptions on goods traded within the free zones or re-exported outside the UAE.

No minimum capital requirement

In many cases, the UAE does not enforce a minimum capital requirement, making it easier for startups and small businesses to establish operations without substantial initial capital. This flexible policy has encouraged a diverse range of businesses—from lean startups to multinational corporations—to launch or expand in the UAE.

Restructuring relief

When businesses reorganize through mergers, spin-offs, or other restructuring deals where business assets are exchanged for shares/ownership, they can qualify for tax relief if they meet these requirements:

- The deal follows UAE regulations.

- The businesses involved must either:

- Be UAE residents; or.

- Have a permanent establishment in the UAE.

- None of the businesses can be tax-exempt or a Qualified Free Zone Person.

- All parties must:

- Share the same financial year.

- Use identical accounting standards.

The restructuring must have legitimate business or economic reasons. Important thing to note, if within 2 years after the restructuring, either:

- The transferred assets are sold to an outside party, or

- The shares received in exchange are sold or transferred.

Then any gains or losses from the original transfer must be reported in the tax period when this subsequent transfer happens.

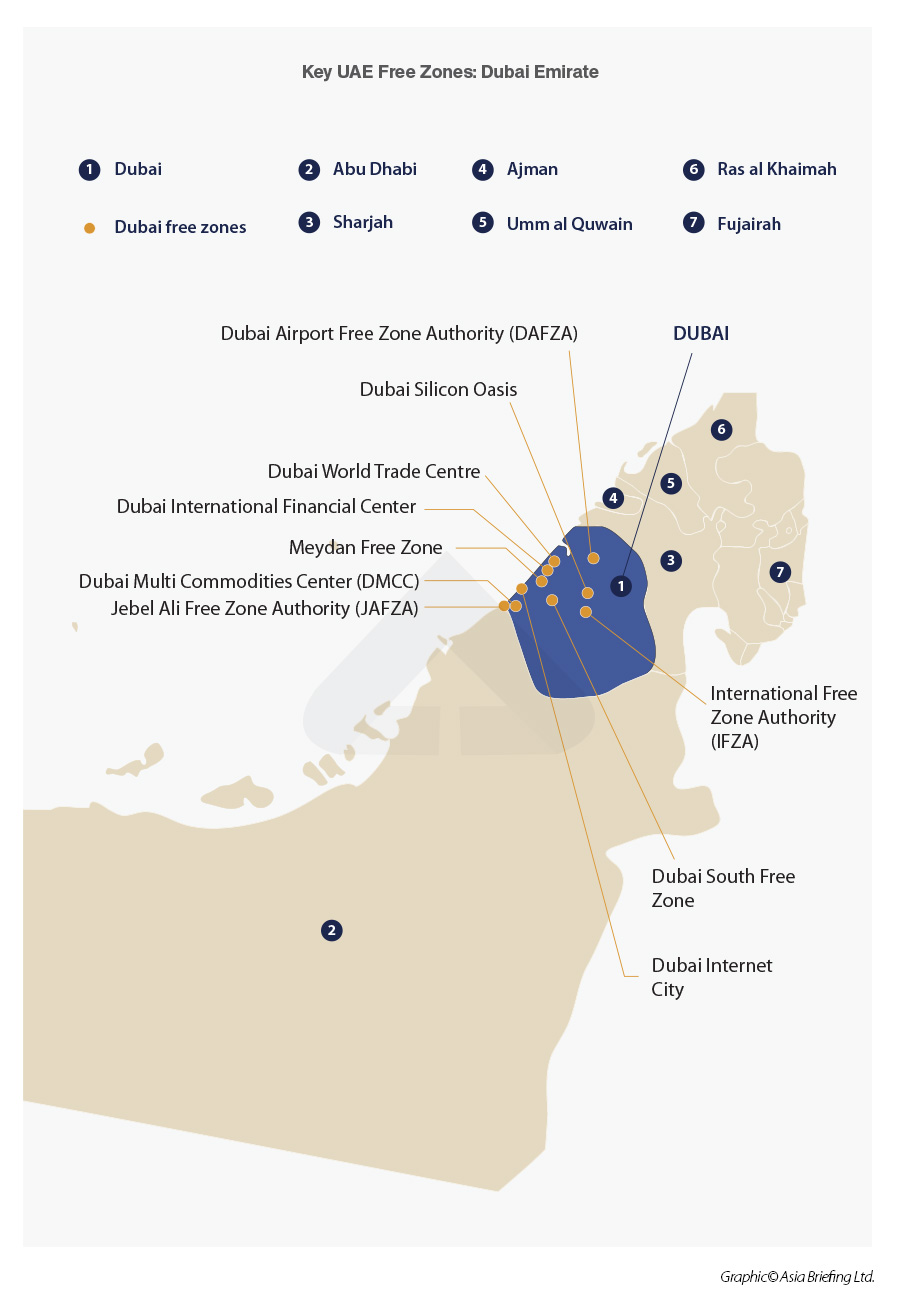

Free Zones and Special Economic Zones

Free zones in the UAE operate as designated economic areas where companies benefit from regulatory and tax exemptions designed to simplify business operations. These zones allow for 100% foreign ownership, offer zero import and export duties, and often include a 0 percent corporate tax rate on qualifying income if companies meet specific requirements, including maintaining adequate substance and engaging in qualifying business activities. In exchange, businesses registered in these zones must follow the UAE’s Federal Tax Authority (FTA) compliance guidelines, which include adherence to transfer pricing and financial reporting standards.

Free zones are tailored to accommodate the operational needs of various industries, from logistics and finance to media, technology, and healthcare. This sector-specific focus has enabled businesses to establish their operations in an environment equipped with the infrastructure and regulatory frameworks best suited to their industries. In addition, free zones streamlined administrative processes—such as expedited company registration and simplified visa applications—further attract international businesses and support rapid setup and expansion.

Sector-specific Free Zones

Each free zone in the UAE is designed with specific industries in mind, providing companies with industry-relevant advantages and resources. For instance:

- Dubai Maritime City: Dedicated to the maritime industry, offering services and facilities for shipbuilding, marine services, and maritime education.

- Dubai Commercity: The first free zone focused on e-commerce, providing infrastructure for online businesses to thrive in the MENA region.

- Dubai South: A master-planned city centered around Al Maktoum International Airport, designed to be a hub for logistics, aviation, and commerce.

- Dubai World Trade Center: A global hub for trade and exhibitions, facilitating international business connections.

- Dubai Design District: A creative ecosystem for designers, artists, and creatives, supporting industries in fashion, art, and digital media.

- Dubai Science Park: Catering to the life sciences, energy, and environmental sectors, fostering innovation in healthcare and sustainable industries.

- International Humanitarian City: A global humanitarian hub, home to international aid organizations and emergency response operations.

- Dubai Multi Commodities Center (DMCC): A leading free zone for trade, particularly in precious commodities like gold and diamonds, with a thriving business community.

- Dubai Outsource City: Specializes in outsourcing services, offering a business-friendly environment for BPO, call centers, and back-office functions.

- Dubai Silicon Oasis: A technology park focused on innovation, attracting companies in tech development, IT, and electronics manufacturing.

- Dubai Internet City: A global ICT hub, home to leading technology companies, offering world-class infrastructure for digital businesses.

- Dubai International Financial Centre (DIFC): A premier financial hub in the Middle East, Africa, and South Asia, with its own legal framework for financial services.

- Meydan Free Zone: Positioned to support businesses in a variety of sectors, with a focus on hospitality, logistics, and events.

- IFZA (International Free Zone Authority)

- Dubai Healthcare City: A world-class center for healthcare services, research, and medical education, attracting leading global healthcare providers.

- Dubai Production City: Catering to media production, this zone supports companies in broadcasting, film, and publishing.

- Dubai International Academic City: Dedicated to higher education, housing international universities and educational institutions.

- Dubai Studio City: Focuses on the media, entertainment, and broadcasting sectors, providing infrastructure for film and TV production.

- Dubai Media City: A thriving media ecosystem for advertising, communication, and media companies.

- DAFZ Industrial Park: Part of Dubai Airport Free Zone, providing industrial and logistics facilities close to Dubai International Airport.

- Gold and Diamond Park: A unique zone focused on the trading of precious metals and jewelry, offering facilities for manufacturers and retailers.

- Dubai Airport Free Zone (DAFZA): Located near Dubai International Airport, this zone offers businesses quick access to international markets and extensive logistics support.

- Dubai Knowledge Park: Supports human resource management, training, and professional development companies.

- Dubai Auto Zone: Dedicated to the automotive industry, providing a marketplace for car dealerships, distributors, and service providers.

- Jebel Ali Free Zone (JAFZA): One of the world’s largest and most established free zones, serving as a global hub for trade, logistics, and manufacturing.

- Expo City Dubai: Created around the legacy of Expo 2020, this zone fosters innovation and sustainability, designed to attract businesses from diverse sectors.

These zones have become critical for companies seeking global market reach. Their strategic locations close to major ports, airports, and transportation networks have cemented the UAE’s position as a global logistics and trade hub, enabling rapid movement of goods across Europe, Asia, and Africa.

Compliance and qualifying criteria for tax incentives

Companies in the specific Qualified UAE’s free zones can benefit from a 0 percent corporate tax rate on qualifying income, provided they meet specific eligibility criteria.

Core income-generating activities must occur within the free zone, either directly or through supervised outsourcing to related parties or third-party providers in the zone.

Qualifying activities generally include manufacturing, trading, warehousing, and other industry-specific operations. Revenue derived from transactions with other free zone entities is generally tax-exempt, while certain activities—such as transactions with UAE mainland customers or regulated financial services—fall under "excluded activities" and may be taxed at a 9 percent rate. To retain its QFZP status, a company’s revenue from excluded or non-qualifying activities must not exceed 5 percent of its total revenue or AED 5 million, whichever is lower.

Failure to comply with these criteria results in the company being taxed at the standard 9 percent corporate tax rate for a minimum of five years, underscoring the importance of maintaining compliance with free zone regulations.

Government support and initiatives

Support for Startups and SMEs

The UAE considers small and medium-sized enterprises (SMEs) crucial to its economy and has developed numerous programs to support these businesses. Major government-backed initiatives include The Khalifa Fund for Enterprise Development and Entrepreneurial Nation, both of which provide financial support, mentorship, and opportunities for networking and market access.

The Khalifa Fund for Enterprise Development is a prominent resource that provides loans, advisory services, and educational resources to UAE entrepreneurs. Programs under the fund include the Khalifa Fund Membership Program, which connects businesses with opportunities for international market participation, events, and exhibitions that enhance visibility and industry connections. Additionally, the Mohammed Bin Rashid Establishment for SME Development aids businesses with financing, trade licensing, and promotional support, helping small businesses scale and thrive in the UAE’s competitive landscape.

The Entrepreneurial Nation platform, launched by the Ministry of Economy, also offers support by connecting startups to a network of investors, offering capital through programs like the Huawei Cloud Startup Program—which provides cloud services and training worth up to AED 550,000 (approximately USD 149,761) —and the Abu Dhabi Investment Office (ADIO) program, which offers resources for startups to grow in the capital city. These initiatives help bridge the gap between budding entrepreneurs and well-established market players, creating a collaborative environment where innovation and growth are prioritized.

The UAE’s focus on tech entrepreneurship is also evident through its incubators and accelerators. These initiatives target technology-driven companies and provide tailored support for scaling up through funding, market entry support, and partnerships with established companies across various sectors. Such a system of incubators and accelerators fosters a fertile ecosystem for startups and promotes industry innovation across the board.

Long-term residency options

In support of business stability and continuity, the UAE offers the Golden Visa program, providing ten-year residency visas to investors, entrepreneurs, and highly skilled professionals. This program enables qualifying individuals and their families to live, work, and study in the UAE, giving business owners the security and stability needed to build their enterprises over the long term.

The Golden Visa is particularly attractive to those seeking a stable base for their business operations in the region. By eliminating the need for frequent visa renewals, the program allows entrepreneurs and investors to focus on long-term business strategies and growth. This is especially beneficial for tech entrepreneurs, investors, and specialized professionals in sectors such as healthcare, engineering, and information technology, as it allows them to bring their expertise and build a sustainable business presence in the UAE.