The United Arab Emirates (UAE) has rapidly emerged as one of the most attractive global destinations for investment. Positioned at the crossroads of Asia, Europe, and Africa, the UAE offers unmatched access to some of the world’s fastest-growing markets. With a robust economic framework, business-friendly policies, and a future-focused approach to development, the UAE presents unparalleled opportunities for global businesses to thrive.

This article explores the key reasons to invest in the UAE and links to detailed resources on specific aspects of doing business in this vibrant nation:

- Economic growth and investment potential in the UAE

- Strategic location: Gateway to global markets

- Double tax and free trade agreements: Strengthening global trade

- Business advantages and government incentives

- UAE free trade zones: A gateway to industry-specific opportunities

- Political stability and investor confidence

- Innovation, talent, and a future-ready ecosystem

- Lifestyle advantages for expatriates and families

Economic resilience and growth potential

The UAE’s economy is built on a foundation of stability and resilience. Over the years, it has successfully transitioned from an oil-dependent economy to a diversified global hub for trade, tourism, finance, and innovation. In 2024, the country is expected to achieve a GDP of AED 1.7 trillion, with non-oil foreign trade exceeding AED 2.8 trillion in the first nine months, setting a national record, and a testament to the success of its diversification strategies.

Major industries, including technology, real estate, and renewable energy, have flourished under the government’s forward-thinking initiatives, such as the "We the UAE 2031" vision. This strategy not only aims to grow GDP to AED 3 trillion by 2031 but also reinforces the UAE’s commitment to sustainable and inclusive economic growth. The UAE is also a magnet for foreign direct investment (FDI), attracting $30 billion in 2024 alone, thanks to streamlined regulations, modern infrastructure, and a pro-business environment.

Strategic gateway to global markets

Strategically located at the intersection of three continents, the UAE offers businesses direct access to over three billion consumers within a four-hour flight radius. Its state-of-the-art infrastructure—including Dubai International Airport, one of the busiest in the world, and Jebel Ali Port, a leading global trade hub—ensures seamless connectivity for goods and services.

The UAE’s role as a logistics and trade powerhouse is further supported by ambitious projects like the Etihad Rail, which enhances inter-emirate and regional commerce. For companies seeking a base to expand into emerging markets in the Middle East, Africa, and South Asia, the UAE provides a central and well-connected hub.

Double Tax and Free Trade agreements: Strengthening global trade

The UAE’s robust network of Double Taxation Avoidance Agreements (DTAAs) and Free Trade Agreements (FTAs) reflects its strategic commitment to fostering international trade and investment. By reducing tax burdens and streamlining trade regulations, these agreements position the UAE as an essential bridge between global economies.

Double Taxation Avoidance Agreements (DTAAs)

The UAE has established an impressive portfolio of over 140 DTAAs, providing businesses and individuals with significant advantages. These agreements prevent income from being taxed twice—once in the UAE and again in a foreign jurisdiction—thereby easing the financial and administrative burdens on international businesses. For example, companies benefiting from the UAE-India DTAA enjoy reduced withholding tax rates on dividends and royalties, facilitating smoother cross-border operations.

These agreements also encourage regional headquarters to be based in the UAE, with key markets such as the UK, China, and Singapore covered under its tax treaties. The result is a highly favorable environment for multinational corporations seeking to streamline their tax structures while taking advantage of the UAE’s strategic location.

Free Trade Agreements (FTAs)

In addition to DTAAs, the UAE has signed several Free Trade Agreements, including Comprehensive Economic Partnership Agreements (CEPAs) with countries like India, Indonesia, and Turkey. These agreements reduce tariffs, improve market access, and facilitate smoother trade flows across borders. For businesses based in the UAE, FTAs unlock new opportunities by making their goods and services more competitive in international markets.

For instance, the UAE-India CEPA, implemented in 2022, has significantly boosted bilateral trade by eliminating tariffs on a wide range of goods, while also supporting services sectors like technology and finance. Similarly, agreements with emerging markets such as Indonesia are creating new avenues for UAE-based companies to expand into high-growth economies.

Together, DTAAs and FTAs are key pillars of the UAE’s global trade strategy, ensuring that businesses can operate seamlessly across borders. These agreements not only enhance the UAE’s position as a global trade hub but also provide investors with the confidence and tools they need to succeed in an interconnected world.

Business-friendly policies and incentives

The UAE has crafted one of the most investor-friendly environments in the world, removing barriers to entry and offering unparalleled advantages for businesses. Reforms such as the 2021 Commercial Companies Law allow 100 percent foreign ownership in most sectors, eliminating the need for a local partner.

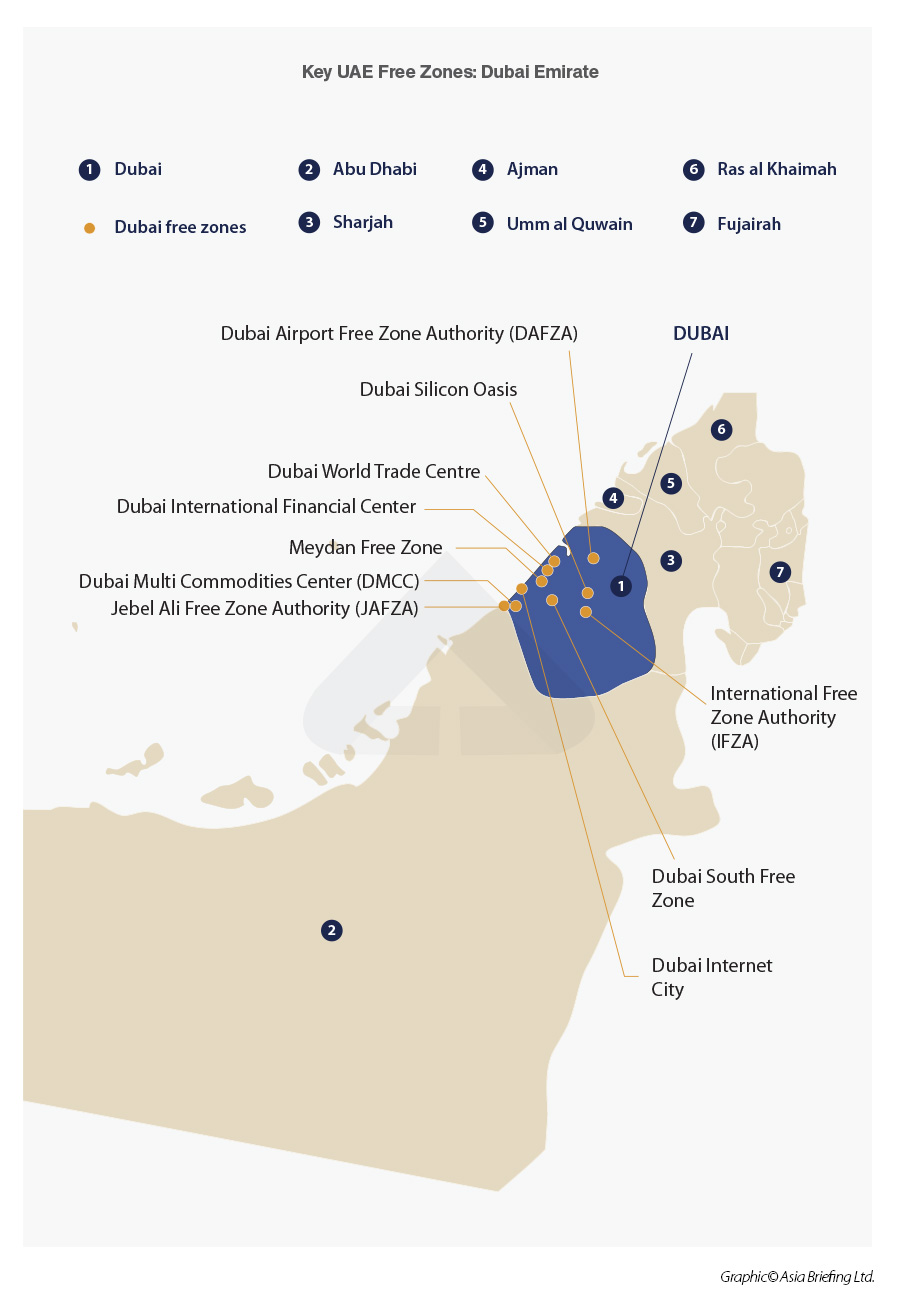

The country’s extensive network of over 40 free zones offers additional incentives, including zero corporate taxes, full profit repatriation, and sector-specific infrastructure. These zones cater to diverse industries, from the Dubai Multi Commodities Centre (DMCC), renowned for its trade in precious metals and stones, to Dubai Silicon Oasis, a hub for technology companies.

Furthermore, the UAE boasts an attractive tax regime with no personal income tax and competitive corporate tax rates. Double taxation agreements (DTAs) with over 140 countries further enhance the ease of doing business by eliminating tax barriers and reducing compliance complexities.

UAE Free Trade Zones

The UAE’s free trade zones are central to its success as a global business hub, providing investors with a unique combination of tax benefits, simplified setup processes, and cutting-edge infrastructure. Spread across the country, these zones cater to a diverse range of industries, offering an ideal environment for businesses to thrive.

Each free zone is tailored to meet the needs of specific sectors, such as technology, media, logistics, and finance. For example, Dubai Internet City supports tech startups and multinational IT firms, while the Jebel Ali Free Zone (JAFZA) is a global logistics powerhouse facilitating seamless trade. These zones not only create a conducive environment for industry growth but also provide businesses with access to vibrant ecosystems of like-minded companies and professionals.

The benefits of operating in these zones are substantial. Investors enjoy 100 percent foreign ownership, which removes the need for local sponsors, ensuring complete control over operations. Additionally, free zones offer corporate tax exemptions and zero customs duties, enabling businesses to maximize profitability. The ability to repatriate profits and capital freely adds another layer of financial flexibility, making the UAE’s free zones particularly appealing to global entrepreneurs and corporations alike.

Furthermore, the streamlined company registration processes in free zones simplify the establishment phase, with many zones offering "plug-and-play" facilities, such as co-working spaces and shared services, to support new businesses. Whether it’s a fintech startup at Abu Dhabi Global Market (ADGM) or a logistics giant at Dubai South, UAE free zones provide the ideal launchpad for success.

Political stability and investor confidence

The UAE’s stable political environment and commitment to law and order create a secure base for investors and expatriates alike. Its governance model prioritizes economic development, ensuring policies remain consistent and supportive of business growth. The country’s low crime rates and robust legal framework protect investor rights, fostering confidence among global companies.

Additionally, the UAE plays a critical role in maintaining regional stability. Its strong diplomatic ties and membership in international organizations like the United Nations and the World Trade Organization (WTO) position it as a reliable partner on the global stage.

Hub for innovation and talent

As a leader in innovation, the UAE has embraced cutting-edge technologies to drive economic growth. Initiatives like the "Smart Dubai" project and the UAE National Innovation Strategy highlight its focus on artificial intelligence, blockchain, and sustainability. These efforts attract companies at the forefront of technological advancements, further solidifying the UAE’s reputation as a global innovation hub.

The country also excels in attracting and retaining top talent. Its diverse workforce, world-class education system, and flexible labor laws make it an ideal location for businesses looking to hire skilled professionals. Programs like the Golden Visa provide long-term residency options for investors, entrepreneurs, and highly skilled individuals, ensuring a steady influx of talent.

Lifestyle advantages for expatriates and families

Beyond its business advantages, the UAE offers a high quality of life, making it an attractive destination for professionals and their families. With advanced healthcare, international schools, and vibrant cultural experiences, cities like Dubai and Abu Dhabi provide a cosmopolitan lifestyle unmatched in the region.

From iconic landmarks like the Burj Khalifa to pristine beaches and world-class shopping, the UAE’s blend of modernity and tradition creates an environment where people can thrive personally and professionally.

Summary: Top reasons to invest in the UAE

The UAE’s economic strength, strategic location, and business-friendly policies create a dynamic environment for businesses to thrive. Whether you’re expanding operations or exploring new markets, the UAE is an ideal destination.

|

Economic Strength |

A GDP of expected AED 1.7 trillion in 2024, with 74.3% generated by non-oil sectors. Robust diversification strategies and $30 billion in FDI inflows highlight the UAE’s growing appeal to global investors. |

|

Strategic Location |

Positioned at the crossroads of Asia, Europe, and Africa, providing access to over 3 billion consumers within a four-hour flight radius. Advanced logistics infrastructure supports global connectivity. |

|

Business Incentives |

100% foreign ownership allowed in most sectors, no personal income tax, and corporate tax exemptions in free zones. Over 140 DTAAs and multiple FTAs reduce tax burdens and promote international trade. |

|

Free Trade Zones |

More than 40 specialized zones tailored to industries such as technology, media, and logistics, offering tax exemptions, profit repatriation, and fast business setup processes. |

|

Political Stability |

A secure and investor-friendly environment with low crime rates, strong legal protections, and a consistent pro-investment policy framework. |

|

Innovation & Talent |

Government-led initiatives in AI, blockchain, and sustainability. A diverse workforce supported by flexible labor laws and long-term residency options, such as the Golden Visa, attracts top talent. |

|

Quality of Life |

Advanced healthcare, international schools, and a cosmopolitan lifestyle. Vibrant cultural offerings, modern infrastructure, and a family-friendly environment make the UAE an exceptional place to live and work. |