Value Added Tax, commonly known as VAT, is a type of indirect tax imposed on the consumption of goods and services at each stage of production or distribution. Unlike income or corporate taxes that target earnings, VAT is levied on the “value-added” at every phase of the supply chain, including production, wholesale, and retail. This makes it a consumption tax, where the end consumer ultimately bears the cost.

Introduction date and rate

The United Arab Emirates introduced Value Added Tax (VAT) on January 1, 2018, marking a significant shift in the country’s fiscal strategy. The VAT rate was set at 5 percent, applying to most goods and services provided in the UAE.

How VAT works in the UAE

Value Added Tax (VAT) operates as a consumption-based tax applied at each stage of the supply chain, contributing to the nation’s revenue streams while supporting essential public services and economic growth. Introduced at a standard rate of 5% on January 1, 2018, VAT is collected by businesses on behalf of the government. This subsection explores how VAT collection functions within the UAE, including the mechanisms by which it is applied across the supply chain, businesses’ roles in VAT collection, and the process for calculating VAT on goods and services.

Mechanism of VAT collection

- VAT in the UAE is applied at every stage of the supply chain, from production to the final sale to consumers.

- Businesses in the UAE, once registered for VAT, are required to apply a 5 percent VAT rate on all taxable goods and services they supply.

- Each VAT-registered business can offset the VAT collected from customers by the VAT they have paid on business-related purchases.

- Businesses remit only the difference to the government: the VAT collected on sales minus the VAT paid on inputs.

Businesses’ roles in collecting VAT

VAT-registered businesses in the UAE act as intermediaries for the government, collecting VAT from consumers and passing it on to the Federal Tax Authority (FTA).

When a VAT-registered business sells a taxable good or service, it charges 5 percent VAT to the consumer, who ultimately bears the cost. Businesses then report their VAT collections and deductions in periodic filings with the FTA. If they have collected more VAT than they paid on purchases, they remit the difference to the government. Conversely, if they paid more VAT than they collected, they can reclaim the difference.

Businesses play an essential role in this process, as they are required to maintain accurate financial records, document VAT on sales and purchases, and submit VAT returns regularly. These records are crucial for compliance and are subject to audits by the FTA to ensure that businesses meet VAT obligations accurately.

VAT calculation

The formula for calculating VAT in the UAE is straightforward:

VAT = Cost Price x VAT Rate (5%)

For example, if a product costs AED 200, the VAT amount added will be:

VAT=200 AED×0.05=10 AED

Thus, the total cost of the product, including VAT, would be AED 210.

Examples of VAT Calculation:

- Example 1: A customer purchases electronic equipment costing AED 500. The VAT applied would be AED 500 x 5% = AED 25. The total price the customer pays is AED 525.

- Example 2: A VAT-registered retailer buys goods from a manufacturer for AED 1,000 plus AED 50 VAT. The retailer then sells these goods to a consumer for AED 1,500, charging AED 75 VAT (5%). The retailer will remit the difference—AED 75 (sales VAT) minus AED 50 (purchase VAT), resulting in AED 25—to the government.

VAT registration

Both local businesses and international companies operating in the UAE are required to register for VAT once their taxable supplies or imports surpass the mandatory threshold of AED 375,000 (US$ 102,096.37). Even if a business does not meet this threshold, it can still opt for voluntary VAT registration to benefit from input tax credits.

Failing to meet this deadline will result in a fixed penalty of AED 10,000.

Mandatory registration threshold

Businesses with taxable supplies and imports exceeding AED 375,000 annually must register for VAT. This applies to both UAE-based businesses and foreign businesses making taxable supplies within the UAE without a local party accountable for the VAT. Taxable supplies include all sales subject to VAT in the UAE. Registration is mandatory within 30 days of surpassing the threshold to avoid penalties.

Voluntary registration

Businesses with annual taxable supplies or imports exceeding AED 187,500 can opt for voluntary VAT registration. Voluntary registration is beneficial for startups and smaller businesses, as it allows them to reclaim VAT on business expenses, even if they do not meet the mandatory threshold. This option also applies to businesses whose annual expenses exceed AED 187,500, allowing them to recover input VAT on their operational costs.

VAT tax group registration

To qualify for VAT group registration, businesses must meet three fundamental requirements, each designed to ensure proper fiscal integration and control.

Establishment requirement

All participating entities must maintain either a place of establishment or a fixed establishment within the UAE. A place of establishment refers to a legally registered business entity where key management decisions are made, and central operations are conducted. Alternatively, a fixed establishment encompasses any permanent business location, including branches, equipped with adequate human resources and technological infrastructure to facilitate regular business operations.

Related party status

The entities seeking group registration must qualify as related parties. This relationship is defined by economic, financial, or regulatory connections where one entity can exercise control over others, either through legal mechanisms or ownership of shares and voting rights.

Partnership control structure

The organizational structure must demonstrate that one or more persons conducting business in partnership maintain control over the other entities. This control may be evidenced through various means, such as shared officers or directors, or partner relationships across the businesses.

VAT registration process

- First, determine if the business meets the requirements for mandatory or voluntary registration based on the annual taxable turnover or anticipated future turnover.

- Prepare key documents, including:

- A valid trade license to confirm the legal status of the business.

- Memorandum of Association (MOA)

- Certificate of Incorporation

- Bank account information, including the mandatory IBAN letter from the bank.

- Business email address and phone number for communication with the FTA.

- The physical location of the business to verify its presence in the UAE.

- A report of the business’s yearly revenue, used to determine eligibility for VAT registration.

- Letter from customs to FTA with customs details, if the company is registered

- Copies of valid Emirates IDs for all business partners, owners, shareholders, and managers.

- Set up an account on the Federal Tax Authority (FTA) portal to access VAT services and complete the VAT registration form.

- Fill out the VAT registration form with information about business activities, annual turnover, and banking details.

- Follow FTA instructions for any registration fees, ensuring prompt payment if required.

- Upload all required documents, such as financial statements, trade license, and proof of authorization, along with the application to validate the business's eligibility.

- The FTA reviews the application, and if approved, issues a Tax Registration Number (TRN) and VAT certificate within approximately 30 days. The TRN is the business's unique identifier for VAT purposes in the UAE.

VAT returns

A VAT return is an official declaration submitted by VAT-registered businesses (referred to as “taxable persons”) to the FTA at the end of each tax period. This document reports:

- The return details all taxable transactions, including sales and purchases, within the specific tax period.

- It calculates the business’s VAT liability, which is the difference between output VAT (the tax collected on sales) and input VAT (the tax paid on purchases).

If output VAT exceeds input VAT, the difference is paid to the FTA. However, if input VAT is greater than output VAT, the excess can be claimed as a refund or carried over to offset future VAT liabilities.

How to file VAT returns

VAT returns in the UAE are filed electronically through the FTA’s e-Services portal. Before submitting a VAT return, businesses must ensure they have met all reporting requirements, including accurately recording all taxable sales, purchases, and adjustments.

The filing steps include:

- Log in to the FTA’s portal and navigate to the VAT return section.

- Enter the total value of supplies and purchases, along with the respective VAT amounts.

- Carefully review all entries for accuracy before submitting the form electronically. If additional payments are due, the FTA will provide instructions on the payment process.

Tax periods and filing deadlines

|

Tax Period |

Eligibility |

Filing Deadline |

|

Quarterly |

Businesses with an annual turnover below AED 150 million |

Within 28 days of the end of each tax quarter |

|

Monthly |

Businesses with an annual turnover of AED 150 million or more |

Within 28 days of the end of each month |

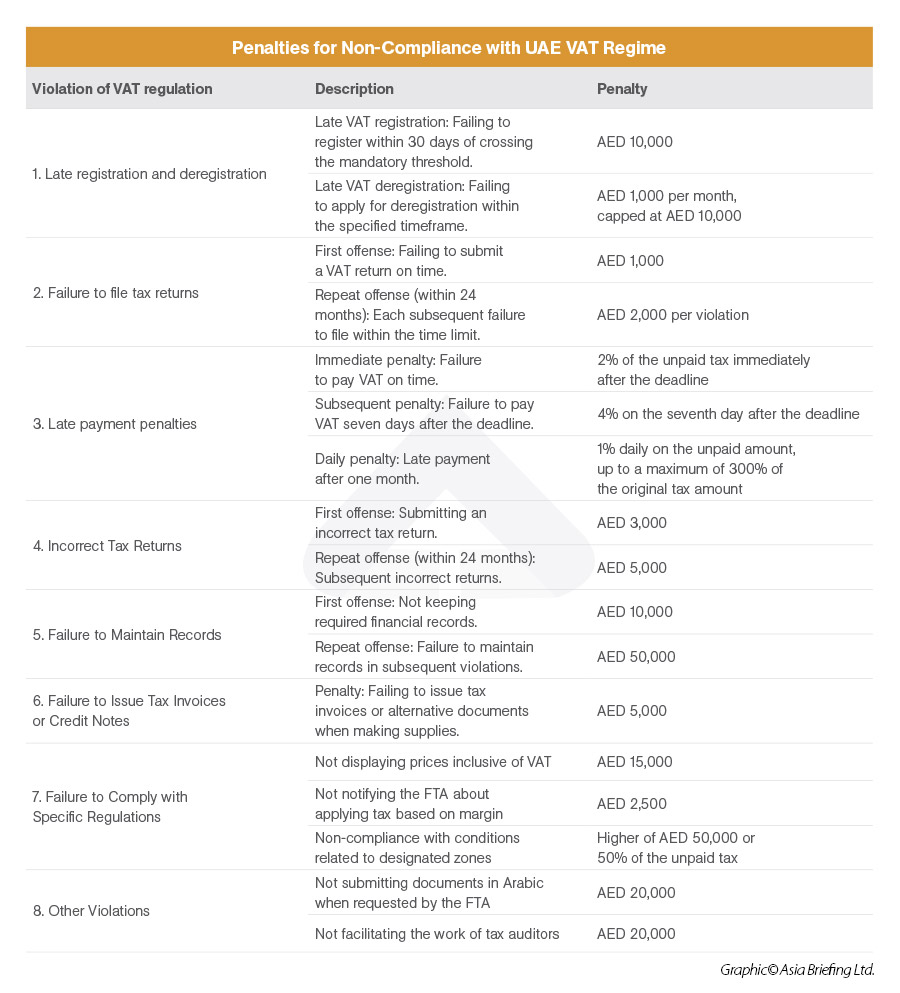

Penalties for late or inaccurate returns

VAT refunds

The UAE provides several types of VAT refunds to support both local and international consumers, businesses, and specific sectors. Understanding eligibility, the types of refunds available, and how to claim them is essential for efficient VAT management.

Eligibility for VAT refunds

- Businesses and individuals eligible for VAT refunds must have incurred VAT on purchases related to business or export activities and meet conditions set by the Federal Tax Authority (FTA).

- Registered businesses can claim VAT refunds if they have paid more VAT on inputs than they have collected on outputs. This net refundable VAT amount can be claimed through a simple process on the FTA portal.

- Specific eligibility applies for refunds under special schemes, which cater to sectors like tourism, real estate, and diplomatic missions, each with its criteria.

Types of VAT refunds available

VAT refunds for tourists

Tourists visiting the UAE are eligible to reclaim VAT on purchases made during their stay. This tax-free shopping benefit applies to goods exported out of the UAE, subject to specific conditions.

Refund Process: Tourists must validate their tax-free purchases at UAE exit points (airports, seaports, or land borders) within 90 days of purchase. Once validated, tourists can collect 85 percent of the VAT paid after a small processing fee of AED 4.80 per item tag, either in cash or credited to a card.

Refunds for foreign businesses

Non-UAE-based businesses can recover VAT paid on expenses incurred while conducting business in the UAE. To qualify, foreign businesses must not be VAT-registered in the UAE and must meet certain FTA requirements, such as providing proof that the expenses were for business purposes.

This scheme is beneficial for businesses attending trade shows, events, or meetings in the UAE, allowing them to offset VAT costs on goods and services during their visit.

Sector-specific VAT refunds

- UAE nationals building their primary residence can claim VAT refunds on construction-related expenses. This benefit aims to support residential development and reduce financial burdens on UAE citizens.

- Eligible international businesses participating in UAE exhibitions and conferences can claim VAT refunds on event-related expenses. This supports the UAE’s positioning as a major hub for global business events.

- Foreign governments, international organizations, and diplomatic missions are eligible for VAT refunds on purchases for official purposes. Such refunds are governed by agreements to ensure alignment with international tax practices.

How to claim VAT refunds

Businesses and individuals can claim VAT refunds through the FTA’s e-Services portal. The steps are as follows:

- Access the FTA portal, select “VAT” under the refund options, and complete the VAT refund request form.

- Provide all required documentation, such as tax invoices, proof of payment, and any additional documentation required for special schemes.

- For tourist refunds, the FTA collaborates with Planet, an exclusive operator, to manage tourist VAT refunds, with digital kiosks available at exit points for easy processing.

VAT de-registration

In the UAE, VAT deregistration is a process that businesses may undergo if they no longer meet VAT registration requirements or if they choose to voluntarily deregister under specific conditions. VAT deregistration frees businesses from the obligations associated with VAT reporting, record-keeping, and tax payments, which can provide strategic financial relief. Below is a comprehensive guide on VAT deregistration requirements, documentation, procedures, and implications in the UAE.

Businesses can deregister for VAT in the UAE under two primary conditions:

Mandatory deregistration:

- If a business is no longer making taxable supplies due to ceasing operations or changing its business model, it must apply for VAT deregistration.

- If the total taxable supply value in the last 12 months falls below the voluntary registration threshold of AED 187,500, deregistration is required.

Voluntary deregistration:

A business that exceeds the voluntary threshold of AED 187,500 but remains below the mandatory threshold of AED 375,000 can choose to deregister voluntarily.

Required documentation for VAT deregistration

The Federal Tax Authority (FTA) requires specific documents based on the reason for deregistration. Here are some common scenarios and documentation requirements:

|

Reason for Deregistration |

Documents Required |

|

Business no longer making taxable supplies |

|

|

Sale or Transfer of License |

|

|

Falling Below Threshold |

|

|

Operating with VAT-Exempt Supplies |

|

|

Branch or Subsidiary Reporting through Parent TRN |

|

All documents must be uploaded in accepted formats (PDF, Excel, Docs, etc.) on the FTA portal, with each file no larger than 5 MB.

VAT deregistration process in UAE

VAT deregistration in the UAE involves a multi-step process, typically completed through the FTA’s EmaraTax portal:

- Log into the EmaraTax portal and select the “De-Register” option under your Taxable Person Account.

- Ensure all pending VAT dues and penalties are paid and submit any outstanding VAT returns.

- File a final VAT return covering the period up to the deregistration date.

- If all requirements are met, the FTA will review the application and, if approved, issue a Deregistration Certificate accessible through the e-Services account dashboard.

The FTA requires businesses to submit their VAT deregistration application within 20 business days from the date they become eligible for deregistration. Failure to meet this deadline results in an initial penalty of AED 10,000, followed by a monthly penalty of AED 1,000 for continued delay. The total accumulated penalties are capped at AED 20,000.

Even after deregistration, businesses are required to retain VAT records for a minimum period. General records must be kept for at least 5 years, capital asset records should be maintained for a minimum of 10 years, and records related to real estate need to be preserved for at least 15 years.

Special VAT rates and exemptions

The UAE’s VAT system includes a well-defined structure for sectors and supplies that are either exempt from VAT or taxed at a zero rate, reflecting the government’s commitment to balancing revenue generation with socio-economic needs. Exemptions and zero-rated supplies help to reduce the tax burden on essential goods and services, particularly in areas like healthcare, education, and affordable housing, thereby enhancing the accessibility and affordability of key services for residents.

Exempt sectors

Certain sectors in the UAE are fully exempt from VAT, meaning businesses involved in these sectors do not charge VAT on their services, nor are they eligible to reclaim any VAT incurred on related business expenses. Key exemptions include:

- Select financial services are VAT-exempt, particularly those that involve the provision or transfer of financial products, such as loans, credit, and life insurance. The exemption helps maintain affordable access to essential financial services, especially for residents seeking life coverage or basic financial products. As of the latest amendments, this exemption now includes services related to the management of investment funds, operations management, and fund performance improvements, providing cost relief for asset managers and investment firms.

- Long-term residential property leases and sales are also exempt from VAT, although commercial properties remain taxable. The recent amendments clarify that government-to-government real estate transfers are not considered VAT-applicable supplies, easing the administrative burden for public sector entities engaged in real estate transactions.

- Local passenger transport, including public options like buses, taxis, and metro services, are exempt from VAT, as is school transportation. This exemption ensures that public and educational transportation remains accessible for all residents without increasing fares.

- The sale or transfer of undeveloped land is also VAT-exempt. This exemption ensures that investors and developers are not burdened with VAT costs on land that has yet to be developed.

- The UAE has introduced VAT exemptions for virtual assets, including cryptocurrencies. The transfer and conversion of virtual assets are now VAT-exempt, which supports businesses in the fast-growing digital currency sector by eliminating VAT-related costs, allowing them to focus on innovation in an area that has faced regulatory uncertainty globally.

Zero-rated supplies

Zero-rated supplies are subject to VAT at a 0 percent rate, which differs from exemptions in businesses dealing with zero-rated goods and services can still reclaim any VAT incurred on their operational expenses. This approach allows businesses to recover costs while delivering certain essential services VAT-free. Notable zero-rated supplies in the UAE include:

- Goods and services exported outside of the GCC are zero-rated, which supports the UAE’s role as a trade hub by ensuring that exported goods and services remain competitively priced in the global market. Under the new amendments, exporters now have simplified documentation requirements to qualify for zero-rated VAT on exports, needing only a combination of customs declarations, shipping certificates, or official documentation as proof.

- International transportation, whether by air, sea, or land, and related goods and services (such as aircraft parts and services for international airlines), are zero-rated. This exemption encourages cross-border trade and simplifies logistics for businesses involved in international commerce.

- When a newly built residential property is supplied for the first time within three years of construction, it qualifies as zero-rated. This helps stimulate the real estate market and reduces the cost burden on buyers, especially those purchasing new homes.

- Specific healthcare services, along with associated goods, such as medications and medical equipment, are zero-rated. This allows healthcare providers to offer essential services without adding a tax cost, thereby maintaining affordability for patients.

- Certain educational services, including tuition, extra-curricular activities, and related goods, such as textbooks, are zero-rated to promote accessible education. Schools and institutions can claim VAT refunds on operational expenses, ensuring these cost savings can be passed on to students and their families.

- Precious metals, like gold and silver with a purity of at least 99 percent, are also zero-rated, which facilitates investment in these assets and enhances the UAE’s standing as a center for precious metal trading.

- The latest amendments also address VAT treatment for composite supplies—transactions involving multiple components with no clear primary component. The clarified guidelines now require that the VAT treatment be based on the overall nature of the transaction, providing clearer tax guidance for businesses engaged in complex, multi-part transactions.

- Another key change relates to employee health insurance costs, where businesses can now recover input tax on health insurance costsfor employees and their dependents.

Partial exemption for mixed supplies

For businesses involved in both taxable and non-taxable (exempt) activities, partial VAT exemptions apply. This means businesses must apportion VAT based on the ratio of taxable to non-taxable supplies. For instance, a financial institution offering both investment products (exempt) and financial consulting services (taxable) may reclaim VAT only for expenses directly related to the taxable activities.