The UAE offers multiple types of business entities, each with distinct benefits, obligations, and limitations. From Limited Liability Companies (LLCs) to Free Zone Entities (FZEs), each business structure is designed to cater to specific operational needs, financial capacities, and industry requirements.

Business jurisdictions in the UAE

The UAE offers three primary jurisdictions for establishing a business: Mainland, Free Zones, and Offshore. Each jurisdiction provides distinct advantages tailored to different business goals, regulatory needs, and operational requirements. The choice of jurisdiction directly influences ownership options, taxation, permissible business activities, and other operational aspects, making it a crucial decision for investors.

Mainland Jurisdiction

Mainland companies in the UAE are established in the country’s onshore market, allowing them to operate freely both within the UAE and internationally. Businesses in this jurisdiction receive their licenses from the Department of Economic Development (DED) in the specific emirate where they are based.

Recent regulatory changes permit 100 percent foreign ownership in most sectors, adding to the mainland’s appeal for foreign investors. Mainland companies are suitable for businesses that plan to trade within the UAE market or take on government contracts. The UAE Commercial Companies Law (CCL) governs most economic activities in onshore UAE. Foreign businesses can operate in this jurisdiction primarily through:

- Limited Liability Companies (LLCs): Traditionally, foreign investors needed a UAE national to hold at least 51 percent of the shares in an LLC. However, recent amendments now allow for 100 percent foreign ownership in majority of sectors, still strategic sectors may require local ownership of 51 percent.

- Branches or Representative Offices: Foreign companies can establish branches or representative offices in the UAE, but these entities do not possess separate legal personalities and are not afforded limited liability protection. A representative office primarily focuses on marketing and promotional activities.

The main advantage of having an onshore entity is the fewer restrictions on business activities and the flexibility in selecting business premises. Mainland companies have access to a range of business licenses:

- Professional;

- Commercial;

- Industrial; and,

- Tourism.

They also benefit from fewer restrictions on office location and business activity, providing greater flexibility compared to other jurisdictions. However, some strategic industries, such as financial services, require UAE national ownership or partnership for licensing. Additionally, a mainland setup may require a larger initial investment and compliance with local laws governing employment, accounting, and company structure.

Free Zone Jurisdiction

Free Zones are designated areas within the UAE specifically created to promote foreign investment by offering favorable terms for international investors. Each free zone operates under its own authority, providing licenses, residency visas, and infrastructure tailored to specific industries, such as logistics, technology, or media. Free zones offer 100 percent foreign ownership, tax exemptions on imports and exports, and full repatriation of profits and capital, making them an attractive choice for foreign entrepreneurs.

The UAE boasts over 46 free zones, with each zone catering to different business needs and regulations. However, free zone companies are generally restricted to operating within their respective free zone and are not permitted to conduct business directly in the mainland market without appointing a local distributor or setting up a mainland branch.

While mainland companies will also need to rent physical addresses and provide lease agreements (“Ejary”), free zones allow flexibility of registering the company without the actual physical address but under the flexi desk if the number of employees is small (generally under 4 visas). However, for some sectors, the bank will require a physical office even for the companies in the free zones.

Free zone licenses permit business activities within the specific free zone but also allow for transactions with customers in other jurisdictions. Common entity types in free zones include:

- Free Zone Establishment (FZE): A single shareholder company.

- Free Zone Company (FZC): A company with two or more shareholders.

- Branch of a Foreign Company: Similar to onshore branches but tailored to the free zone's regulations.

Offshore Jurisdiction

Offshore companies in the UAE are established primarily for the purpose of international business and asset management outside the UAE, making them distinct from free zones and mainland entities. Offshore companies are registered by specific offshore authorities, with options available in Jebel Ali Free Zone (JAFZA), and Ras Al Khaimah (RAK).

Offshore companies are not permitted to conduct business within the UAE market, but they benefit from tax neutrality, privacy, and confidentiality protections that make them popular for holding assets, conducting global trade, or managing wealth.

Offshore companies offer flexibility in terms of ownership, with full foreign ownership allowed. They also provide benefits like no corporate tax, full profit repatriation, and international invoicing capabilities. Offshore entities are often used by investors seeking to establish a presence in the UAE without a physical office or local hires, as these companies do not have residency visas or office lease requirements.

For businesses not planning to engage in activities within the UAE, offshore company formation is an option. Offshore entities generally serve as holding companies and cannot conduct commercial activities or open bank accounts in the UAE. However, they can own freehold property in onshore UAE under certain free zone regulations.

Jebel Ali Free Zone (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC) are notable examples of offshore company jurisdictions. Benefits include no foreign ownership restrictions, no residency requirements for shareholders/directors, and no need for physical office space.

Advantages and limitations comparison

|

Jurisdiction |

Advantages |

Limitations |

|

Mainland |

|

|

|

Free Zones |

|

|

|

Offshore |

|

|

Types of business structures

The UAE provides a diverse range of business structures tailored to meet the unique needs of local and foreign investors. Below is a breakdown of the primary business types, including their characteristics, advantages, disadvantages, and legal responsibilities.

Sole Proprietorship

A sole proprietorship is a business owned and operated by a single individual. This straightforward structure grants the owner complete control over decision-making, profit retention, and operational strategies. However, this comes with a significant caveat: the owner assumes unlimited liability, meaning personal assets are at risk if the business incurs debts or legal obligations.

- Advantages: Simple setup, full control, and direct claim to profits.

- Disadvantages: Unlimited liability can expose personal assets, limited to professional service activities for foreign investors.

- Legal Responsibilities: Sole proprietors are fully liable for business obligations. Foreign nationals in the UAE require a professional license and must appoint a Local Service Agent (LSA) to navigate government procedures, though this agent holds no ownership stake.

Partnerships

General Partnership

A general partnership involves two or more individuals or entities jointly operating a business and sharing profits, responsibilities, and liabilities equally. This structure is available only to UAE nationals and is ideal for businesses that thrive on collaboration. However, each partner bears full liability, putting personal assets at risk if debts arise.

- Characteristics: Equal responsibility and profit-sharing among partners.

- Liability: Unlimited liability, with each partner liable for the business's debts and obligations.

Limited Partnership

A limited partnership is like a general partnership but includes both "general" and "limited" partners. General partners manage the business and assume full liability, while limited partners contribute capital but have limited liability, restricted to their investment.

- Characteristics: Allows for differentiation between management roles and investment roles.

- Liability: Limited partners' liability is capped at their contribution, while general partners remain fully liable.

Limited Liability Company (LLC)

An LLC is one of the most popular business structures in the UAE, particularly among foreign investors. An LLC can have multiple shareholders (up to 50) who enjoy limited liability, with their personal assets shielded from company debts. Recent regulatory updates permit 100 percent foreign ownership in specific sectors, enhancing flexibility for international investors.

- Key Features: Limited liability, diverse ownership structure, and flexibility for management.

- Capital Requirements: Generally, there is no minimum capital requirement, practically, in mainland it will be from 50,000 AED and 10,000 AED in the free zones.Also, specific conditions may apply based on sector.

- Ownership: Foreigners may own 100 percent in certain non-strategic sectors, although strategic activities still require UAE national ownership.

Civil Company

A civil company is a form of partnership designated for professional service providers, such as consultants, doctors, and engineers, who wish to practice collaboratively. Civil companies allow for full foreign ownership, making them attractive to international professionals. However, they require an LSA to liaise with government entities for licensing purposes.

- Purpose: Ideal for consultancy and professional services.

- Ownership: Foreign ownership allowed but requires an LSA if no UAE national partner is involved.

- Legal Responsibilities: Partners have unlimited liability, meaning personal assets may be at risk for company obligations.

Free Zone Company

A free zone company is established within one of the UAE's numerous free trade zones, which are areas designated to attract foreign investment by offering tax exemptions and full foreign ownership. Free zone companies have limited scope to operate outside the free zone, with restrictions on direct trade in the UAE mainland.

- Benefits: 100 percent foreign ownership, tax exemptions, no customs duties within the free zone.

- Limitations: To operate within the mainland UAE, free zone companies must establish a local branch or appoint a distributor.

Branch Offices

Local Branches vs. Foreign Branches

A branch office allows a foreign or local company to expand its presence in the UAE without creating a separate legal entity. Branches may conduct business on behalf of the parent company and operate either as local or foreign branches. Representative offices, a sub-type of foreign branch, are typically limited to promoting the parent company’s products and cannot engage in direct sales.

- Legal Implications: Branches share liability with the parent company and typically require a Local Sponsor for licensing purposes.

- Operational Scope: Local branches can offer full commercial services, while foreign branches have restrictions depending on activity and licensing.

Public Joint Stock Company (PJSC)

A PJSC is a company whose shares are publicly traded, making it an ideal structure for businesses aiming to raise substantial capital through public investment. This structure is typically chosen by larger corporations and requires adherence to stricter regulatory standards.

- Capital Requirements: A minimum of AED 10 million for general companies, with higher requirements for financial institutions.

- Shareholder Structure: Requires at least 10 founding members, with public shares offered to ensure broad ownership.

Private Joint Stock Company (PrJSC)

A PrJSC is a privately held entity that limits shareholding to a select group of investors. Unlike a PJSC, shares in a PrJSC are not publicly traded, offering founders more control over ownership and management decisions.

- Characteristics: Minimum three shareholders with a capped number of 200.

- Capital Requirements: Requires a minimum capital of AED 2 million.

- Ownership: Allows up to 49 percent foreign ownership; GCC nationals can own up to 100 percent.

|

Business Structure |

Ownership |

Liability |

Operational Scope |

Advantages |

Disadvantages |

|

Sole Proprietorship |

100% owned by UAE or GCC nationals; foreigners require a Local Service Agent for licensing and are limited to professional services |

Unlimited liability (personal assets at risk) |

Limited to activities permitted by professional license; can’t engage in import/export or real estate for foreigners |

Simple setup; full control over profits and management |

Unlimited liability; restricted to certain activities for foreign nationals |

|

General Partnership |

Only UAE nationals can form this structure |

Unlimited liability shared among all partners |

Any lawful commercial activity permitted within the UAE |

Collaborative approach; shared responsibility |

Unlimited liability for all partners; only available to UAE nationals |

|

Limited Partnership |

General partners must be UAE nationals; limited partners can be foreigners |

General partners have unlimited liability; limited partners are liable only to their capital contribution |

Suitable for businesses where some partners only contribute capital |

Allows both management and passive investors; limited partners’ liability is capped |

Limited partners have no management role; general partners still have full liability |

|

Limited Liability Company (LLC) |

Foreigners may own 100% in specific sectors; otherwise, foreign ownership capped at 49% unless in designated sectors |

Limited to each shareholder’s investment in the company |

Can operate anywhere in UAE except for restricted activities (e.g., banking, insurance) |

Limited liability; flexible ownership; no national ownership requirement in certain sectors |

Not allowed in specific sectors, such as banking and insurance |

|

Civil Company |

Full foreign ownership allowed, but must appoint a Local Service Agent if no UAE national partner |

Unlimited liability shared among partners |

Restricted to professional services in line with specific regulations |

Ideal for professional services; foreign ownership allowed |

Unlimited liability; restricted to professional services only |

|

Free Zone Company |

100% foreign ownership allowed |

Limited liability |

Can operate within the free zone; requires distributor or branch for mainland operations |

Tax exemptions; no customs duties within free zone; full foreign ownership |

Limited mainland operations without branch or distributor; limited to activities allowed in the free zone |

|

Branch Office (Local) |

Owned by the parent company in the UAE |

Same as parent company’s liability |

Can operate anywhere in the UAE |

Allows existing UAE companies to expand into other emirates |

Liable for parent company’s obligations |

|

Branch Office (Foreign) |

Owned by the foreign parent company |

Same as parent company’s liability |

Limited to specified activities and promotional work; requires approval for direct business |

Cost-effective market entry for foreign companies; no additional capital needed |

Cannot directly conduct sales; limited commercial activities |

|

Public Joint Stock Company (PJSC) |

Minimum 10 founding members; shares offered publicly with restrictions on national ownership for key positions |

Limited liability to shareholder’s investment |

Can operate anywhere in UAE; suitable for larger commercial enterprises |

Access to public capital; share trading allowed on stock exchange |

Extensive regulatory compliance; requires public disclosure and Emirati board members |

|

Private Joint Stock Company (PrJSC) |

Minimum 3 shareholders; up to 49% foreign ownership allowed |

Limited liability to shareholder’s investment |

Can operate within UAE in various sectors, excluding certain professional services |

Flexible ownership; limited public disclosure |

Cannot publicly traded shares; capped number of shareholders |

Business establishment options

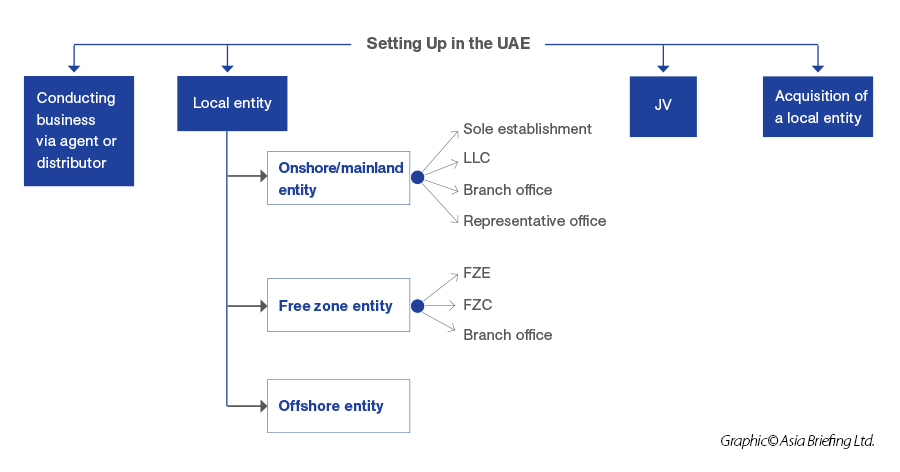

When setting up a business in the UAE, foreign investors have several options to choose from, each with its own regulatory framework and advantages.

Conducting business through an agent/distributor

Foreign companies can avoid the complexities of establishing a physical presence in the UAE by working with a local agent or distributor. This approach leverages the local market connections of the agent or distributor, facilitating market entry.

In the UAE, the terms ‘agent’ and ‘distributor’ are often used interchangeably, although they denote different contractual arrangements. Typically, a local agent or distributor acquires legal title to foreign products before supplying them within a designated territory. This arrangement allows for the provision of certain services in return for a fee, aligning more with a distribution model rather than an agency model, where an agent binds the principal into customer contracts.

Establishing a local entity

Foreign investors can establish a business presence in the UAE through either an onshore (mainland) entity or a free zone entity. The choice between these options largely depends on customer locations and the nature of the business activity.

- Onshore/Mainland

- Free zones

- Offshore establishments

Joint venture

A joint venture (JV) in the UAE is a collaboration where a foreign investor partners with a local firm, typically sharing resources, risks, and profits. JVs are favored by foreign investors looking to benefit from local market insights and the existing regulatory structures of UAE-based partners.

Definition and structure of Joint Ventures

A JV allows a foreign investor and a UAE-based company to establish a mutually beneficial business relationship. Typically, JVs involve shared capital investment, management responsibilities, and profit-sharing agreements based on each party’s contributions.

In most cases, the UAE partner holds a majority interest, ensuring compliance with local ownership laws, although equity distribution can vary based on the terms of the agreement.

Advantages for foreign investors partnering with local firms

- Joint ventures provide foreign investors with streamlined market access, along with reduced risk and greater operational flexibility.

- Local partners contribute essential insights into UAE market trends, regulatory compliance, and consumer behavior—factors crucial for success in an unfamiliar market.

- A JV allows foreign investors to navigate the UAE’s legal environment more effectively and avoid some of the barriers associated with independent business operations.

Acquisition of an existing local entity

Another strategy for market entry is acquiring an existing local business. This approach requires consideration of various factors, including:

- Limited public information available, necessitating thorough due diligence.

- Foreign ownership restrictions on certain license activities.

- Regulatory consents or approvals, such as those from the UAE Central Bank.

- Transfer of employee contracts and visas during asset sales.

- Compliance with UAE end-of-service benefits related to business transfers.

Franchising opportunities

Franchising in the UAE has become a robust avenue for both international brands and local investors. As the UAE's economy has grown, so has the appetite for well-known global brands across various sectors. Franchising offers a reliable model for investors seeking a balance between independence and support from an established brand.

The franchising model allows foreign companies to enter the UAE market without the need for direct establishment costs or unfamiliar regulatory hurdles. By partnering with a local franchisee, foreign brands can ensure their products or services reach consumers under a recognized name while leveraging local expertise. Franchises benefit from the UAE’s tourism influx, high consumer spending, and brand-conscious population, making it a high-potential market for franchising growth.

Popular franchise sectors

Certain sectors dominate the franchise market in the UAE. Food and beverage, retail, health and fitness, and education lead the way, with fast-food chains, boutique fashion brands, fitness centers, and early education institutions particularly popular. These sectors align well with the lifestyle and demand of UAE consumers, who seek high-quality goods and services. Additionally, with digital transformation on the rise, e-commerce and technology service franchises are also emerging, adding new opportunities for investors interested in tapping into this digital shift.

Specialized business types

Franchising and joint ventures offer powerful avenues for investors seeking specialized structures that align with the UAE’s unique economic landscape. Whether leveraging a recognizable brand through franchising or tapping into local expertise via a JV, foreign investors can gain meaningful footholds in one of the Middle East’s most promising markets.

Licensing requirements

Each license type is tailored to specific business activities, with requirements varying by sector and location. Investors can obtain licenses from the Department of Economic Development (DED) in the relevant emirate, either at physical service centers or through online portals.

Overview of licensing types

Professional License

This type of license is designed for service-based activities, such as consulting, IT, education, and healthcare. Enables foreign investors to own 100 percent of the business, though a Local Service Agent (LSA) may be required. Generally, this license is chosen by individual professionals or specialist firms.

Commercial License

The license covers trading and commercial activities, including import/export, retail, and general trading. Commercial license allows businesses to engage in buying and selling goods within the UAE market and often selected by investors in trading, logistics, and general commerce.

Industrial License

This specific license is necessary for manufacturing, processing, and other industrial activities. An industrial license requires additional clearances from regulatory bodies overseeing environmental and health standards. And it best suited for companies involved in production and assembly within UAE-based facilities.

Tourism License

This license specifically intended for businesses within the travel, tourism, and hospitality sectors. The license covers activities such as travel agencies, hotels, and tour operators. It also helps ensure compliance with tourism regulations in the UAE, a major global travel hub.

Steps to obtain necessary licenses based on business type

To set up a licensed business entity in the UAE, follow these general steps:

- Submit an application along with relevant documentation to the DED or relevant free zone authority for initial approval.

- This initial approval indicates that your business type is acceptable under UAE regulations.

- Choose and register a unique trade name, following UAE naming conventions. Foreign trade names may require additional approvals and could add to the setup cost.

- Gather the required documents, including:

- Initial approval receipt and previously submitted documents

- A notarized lease agreement, approved by the Real Estate Regulatory Agency (RERA) if within Dubai

- A memorandum of association (MOA) or a Local Service Agent agreement, depending on business type.

- Depending on your business activity, you may need further approvals from specific government bodies. For example, tourism companies may require approvals from the Department of Tourism, while industrial businesses might need clearance from environmental and health authorities.

- Pay the licensing fee within 60 days of approval notification to avoid application expiration. License fees range widely, typically from AED 10,000 to AED 35,000 (approximately USD 3,6725 to 9,530,), though additional approvals or unique requirements may increase the cost.

- Once processed, the business license can be collected from the DED service centers or downloaded online. This document grants the authority to operate within the licensed activities.