Transfer pricing refers to the practice of setting prices for goods, services, or intangible assets exchanged between entities within the same multinational enterprise (MNE). It ensures that these intercompany transactions comply with the arm's length principle, meaning that the prices charged are comparable to those that would occur between independent parties in similar circumstances.

For multinational corporations (MNCs), transfer pricing has a role in managing cross-border transactions and aligning with international tax standards. Proper transfer pricing not only aids in regulatory compliance but also minimizes risks of disputes with tax authorities, which could lead to penalties or double taxation.

The arm’s length principle and Federal Decree-Law No. 47 of 2022

The UAE introduced a comprehensive corporate tax framework through Federal Decree-Law No. 47 of 2022, which incorporates dedicated provisions on transfer pricing. These regulations mandate that all UAE taxpayers adhere to the arm’s length principle for related-party transactions. This alignment with OECD guidelines reflects the UAE’s commitment as a member of the Inclusive Framework on BEPS since 2018.

Recent updates, including Ministerial Decision No. 97 of 2023, have provided detailed guidance on transfer pricing documentation requirements.

The UAE's transfer pricing framework, anchored in the arm's length principle, requires businesses to ensure their related-party transactions reflect market-driven pricing dynamics. Under the Federal Tax Authority's guidelines, companies exceeding AED 200 million in revenue or part of multinational groups with global turnover above AED 3.15 billion must maintain comprehensive documentation, including local and master files, while submitting an annual Transfer Pricing Disclosure Form with their corporate tax return.

For larger multinational enterprises, Country-by-Country Reporting obligations apply to groups with revenues exceeding AED 3.15 billion, with reports due within 12 months of the fiscal year-end. This robust compliance framework, supported by penalties of up to AED 1,000,000 for non-compliance, aligns with the OECD's Base Erosion and Profit Shifting initiatives and reinforces the UAE's commitment to maintaining tax system integrity while fostering transparent business practices.

Key components of transfer pricing in the UAE

Transfer pricing methods

There are five globally recognized transfer pricing (TP) methods established in the OECD Transfer Pricing Guidelines, which are also adopted under Article 34(3) of the UAE’s Corporate Tax Law. These methods are designed to evaluate whether transactions between related parties comply with the arm’s length principle.

The Comparable Uncontrolled Price (CUP) Method, Resale Price Method (RPM), and Cost Plus Method (CPM) fall under the category of traditional transaction methods. These methods are often regarded as the most straightforward approach to determine whether the terms of commercial and financial dealings between related parties reflect arm’s length standards. This is because any variance between the price of a controlled transaction and a comparable uncontrolled transaction can typically be directly traced to the underlying commercial and financial arrangements. The arm’s length nature of a transaction can be established by substituting the price of a comparable uncontrolled transaction for that of the controlled transaction.

On the other hand, the Transactional Net Margin Method (TNMM) and Profit Split Method (PSM) are classified as transactional profit methods. These are particularly useful when both parties to a controlled transaction contribute unique and valuable elements or operate in highly integrated activities. These methods are also applicable in cases where public data on third-party transactions is scarce or unavailable. When both parties perform distinct and significant functions, two-sided methods like TNMM or PSM are often better suited than the one-sided approaches offered by traditional methods.

TP methods are crucial for ensuring that controlled transactions between related parties adhere to the arm’s length principle. They offer a structured framework for multinational enterprises (MNEs) and tax authorities to evaluate whether the pricing of such transactions is appropriate. By leveraging the outcomes of a comparability analysis, these methods allow the assessment of transfer prices or profits from controlled transactions against those observed in comparable uncontrolled transactions conducted between independent parties.

The selection of the most appropriate Transfer Pricing method involves:

- Assessing the strengths and weaknesses of the five recognized methods.

- Evaluating the suitability of each method based on the nature of the Controlled Transaction, as determined through Functional Analysis.

- Ensuring the availability of reliable information, particularly on uncontrolled comparables, including whether commercial databases or other sources can provide necessary data.

- Considering the degree of comparability between Controlled Transactions and independent transactions, including the need for accurate adjustments to address differences.

The UAE Federal Tax Authority prefers applying TP methods at the transactional level, but methods like TNMM may sometimes be used on an aggregated basis to assess overall profitability.

In some cases, using a single TP method may not fully capture the arm’s length price due to inconclusive results or difficulties in applying adjustments. In such instances, combining methods can provide a more accurate assessment. The goal is to reach a conclusion that reflects the facts, circumstances, and evidence available.

For example, if the Resale Price Method is challenging due to issues with adjustments, the Transactional Net Margin Method might be used alongside RPM. This combination allows for a corroborative analysis to ensure the transaction aligns with the arm’s length principle by comparing net margins under appropriate profit level indicators.

Transfer pricing compliance

UAE taxpayers must file a Transfer Pricing disclosure form as part of their corporate tax return, except those claiming Small Business Relief. Taxpayers with turnover exceeding AED 200 million or part of a multinational group with a global turnover above AED 3.15 billion are required to prepare a local file and master file annually.

Article 55 of the UAE CT Law outlines the transfer pricing documentation obligations for taxable persons engaging in transactions with related parties or connected persons. The purpose of transfer pricing (TP) documentation is to provide the FTA with a clear and comprehensive understanding of the taxable person's TP policies and their implementation, enabling the FTA to assess the TP outcomes for each relevant review period. The UAE CT Law specifies the following TP documentation requirements for certain taxable persons, which must be prepared for each tax period:

- Transfer Pricing Disclosure Form (TPDF)

- Master File (MF)

- Local File (LF)

- Country-by-Country Report (CbCR)

- Additional supporting information upon request by the FTA for the relevant tax period.

TPDF

A TPDF must be prepared and submitted by all taxable persons engaging in transactions with related parties and connected persons that exceed a yet-to-be-defined materiality threshold. The TPDF is required to be submitted with the Corporate Tax return, which is due nine months after the end of the relevant tax period.

MF and LF

A taxable person must prepare and maintain a Master File and Local File if they meet one of the following criteria during the relevant tax period: being part of a Multinational Enterprises (MNE) Group with consolidated revenue of AED 3.15 billion or more, or having revenue of AED 200 million or more. However, taxable persons within a UAE-headquartered group that is not an MNE Group are exempt from maintaining an MF but must still maintain an LF if they meet the revenue thresholds. The Federal Tax Authority (FTA) can request this documentation, which must be provided within thirty days or by a later date specified by the FTA.

CbCR

On April 30, 2019, the UAE issued Cabinet Resolution No. 32 of 2019, which pertains to Country-by-Country Reporting. The CbCR rules established in the Resolution align with the guidance provided by the OECD on CbCR. As specified in the Resolution, CbCR requirements apply to financial reporting years beginning on or after January 1, 2019.

The Country-by-Country Reporting (CbCR) regulations in the UAE are applicable to multinational groups with revenues exceeding AED 3.15 billion (approximately USD 858 million) for fiscal years beginning on or after 1 January 2019. The notification must be submitted by the UAE tax-resident Ultimate Parent Entity (UPE) on behalf of the UAE Constituent Entities to the UAE Ministry of Finance (MoF). This notification must confirm the UPE’s responsibility for submitting the CbC Report and identify the UAE Constituent Entities by the last day of the group’s reporting year. The CbC Report must be filed within 12 months after the conclusion of the reporting fiscal year of the multinational enterprise (MNE), following the standard template outlined in Annex III of Chapter V of the OECD Transfer Pricing Guidelines.

CbCR reporting requirements

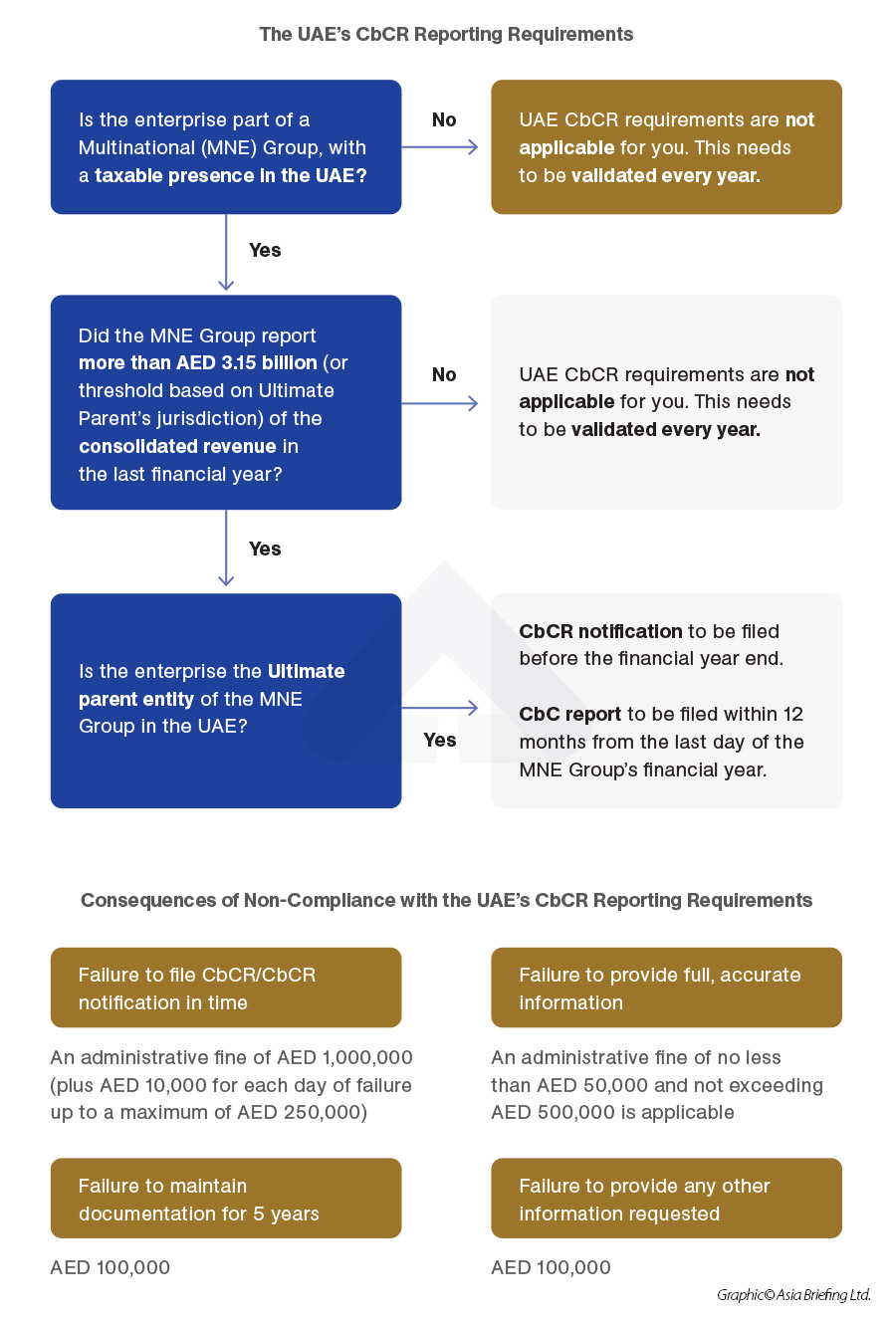

- Step 1: Check taxable presence and group status

- If the enterprise is not part of an MNE Group with a taxable presence in the UAE, CbCR requirements are not applicable.

- This status must still be validated every year.

- Step 2: Check revenue threshold

- If the enterprise is part of an MNE Group, determine if the group’s consolidated revenue exceeded AED 3.15 billion (or the threshold specified by the Ultimate Parent’s jurisdiction) in the last financial year:

- If below AED 3.15 billion, CbCR requirements are not applicable.

- This status must also be validated annually.

- If above AED 3.15 billion, proceed to Step 3.

- Step 3: Determine Ultimate Parent Entity status

- If the enterprise is the Ultimate Parent Entity of the MNE Group in the UAE:

- A CbCR notification must be filed before the end of the financial year.

- A CbCR report must be filed within 12 months from the last day of the MNE Group’s financial year.

- If the enterprise is not the Ultimate Parent Entity, further analysis is required to confirm CbCR applicability.

- Annual validation requirement

- Regardless of the situation, the applicability of CbCR requirements must be reviewed every year.

Consequences of non-compliance with CbCR reporting requirements

|

Violation |

Penalty |

|

Failure to file CbCR / CbCR notification in time |

AED 1,000,000 (plus AED 10,000 for each day of failure up to a maximum of AED 250,000) |

|

Failure to provide full, accurate information |

An administrative fine of no less than AED 50,000 and not exceeding AED 500,000 |

|

Failure to maintain documentation for 5 years |

AED 100,000 |

|

Failure to provide any other information requested |

AED 100,000 |

Individuals or entities engaged in business activities who fail to maintain required records as mandated by the Tax Procedures Law and the Corporate Tax Law will face penalties of AED 10,000 for each violation, increasing to AED 20,000 for repeated violations within 24 months. Additionally, non-compliance with CbCR and notification requirements can result in penalties ranging from AED 10,000 to AED 1,000,000.

Advance pricing agreements

According to Article 59(1) of the UAE Corporate Tax Guide, taxpayers may request clarification from the Authority regarding the application of the Decree-Law or seek an advance pricing agreement (APA) for a proposed or existing transaction or arrangement.

The Federal Tax Authority (FTA) has released additional information on the upcoming APA framework in an update to Decision No. 4 of 2024. While the update does not detail the specific procedures or technical requirements for the APA process, it specifies the minimum information needed for individuals requesting clarification from the FTA about the APA framework.

Foreign currency controls in the UAE

The UAE's regulatory framework for currency transactions is straightforward. The absence of foreign exchange controls means businesses and individuals can freely move capital in and out of the country, convert currency at will, and maintain foreign currency accounts without bureaucratic hurdles. This policy has proven particularly attractive to multinational corporations seeking a regional headquarters location.

The most significant aspect of the UAE's currency management is the dirham's long-standing peg to the US dollar at a fixed rate of 3.6725 dirhams per dollar. Maintained since 1997, this peg has provided stability for international trade and investment.

The combination of zero currency restrictions and a stable exchange rate has created a powerful engine for trade finance. Local banks routinely provide instruments such as letters of credit, bank guarantees, and trade finance solutions that oils the wheels of commerce between the UAE and its global trading partners.

For example, the case of re-export trade through Dubai's ports. The absence of currency controls means traders can quickly execute transactions in multiple currencies, making Dubai an ideal hub for regional trade. Local banks have stepped up to support this activity, offering competitive forex rates and efficient settlement services that keep goods moving smoothly through the emirate's busy ports.

Implications for business operations

For businesses operating in or through the UAE, the liberal currency regime translates into several practical advantages. The ability to maintain accounts in multiple currencies, repatriate profits without restrictions, and hedge currency exposure through various financial instruments provides operational flexibility that few other jurisdictions can match.

Moreover, the dollar peg offers a natural hedge for companies trading with the US or in dollar-denominated commodities. This has proven particularly valuable for the UAE's oil exports and has helped attract businesses in sectors ranging from precious metals trading to cryptocurrency exchanges.

The UAE's approach to currency management reflects a broader commitment to business-friendly policies.

Interaction between transfer pricing and foreign currency controls

As multinational corporations (MNCs) continue expanding into diverse jurisdictions, the intersection of transfer pricing regulations and foreign currency controls becomes an increasingly complex aspect of their operations. In the UAE, where transfer pricing compliance is aligned with OECD guidelines, businesses must carefully balance regulatory requirements with foreign currency risks to ensure smooth cross-border transactions.

MNCs often operate in jurisdictions with varying rules on both transfer pricing and currency controls. This creates several challenges, particularly when managing intercompany transactions involving multiple currencies. For example:

- Some countries impose strict foreign exchange controls that limit the movement of funds across borders. These restrictions can delay or complicate the timely settlement of intercompany pricing arrangements.

- Volatility in currency exchange rates adds a layer of unpredictability to transfer pricing outcomes. A pricing arrangement considered arm's length under stable exchange rates might deviate under fluctuating conditions, creating compliance risks.

- Different countries may impose inconsistent regulations on currency conversions, which can complicate the comparability analysis used in transfer pricing documentation.

For MNCs operating in the UAE, these challenges can be particularly pronounced when navigating transactions involving markets with high currency volatility or restrictive foreign exchange regimes.

To address these challenges, corporations must adopt a proactive and integrated approach to managing both transfer pricing and foreign currency risks. Key strategies include:

- Incorporating currency adjustments into intercompany agreements can help mitigate the impact of exchange rate fluctuations. For instance, price adjustments or hedging mechanisms can ensure that pricing remains consistent with the arm's length principle, even when currency values shift.

- Conducting regular financial modeling to evaluate potential exchange rate movements is crucial. This allows companies to identify areas where currency volatility may affect compliance and profitability.

- Transfer pricing documentation should account for the financial effects of currency fluctuations. By clearly documenting the rationale for pricing adjustments or hedging strategies, businesses can strengthen their defense in case of regulatory audits.

- Partnering with local advisors in jurisdictions with stringent currency controls can help ensure compliance while reducing operational inefficiencies.

Currency fluctuations have a profound impact on transfer pricing strategies, influencing both profitability and compliance. A sudden depreciation of a local currency can increase the costs of intercompany transactions denominated in foreign currencies, potentially skewing the arm’s length nature of the pricing. Conversely, currency appreciation may lead to windfall profits that regulators may question.

In response, MNCs often use financial instruments like forward contracts or natural hedging to stabilize cash flows. While these tools help mitigate risks, they must be carefully aligned with the company’s transfer pricing framework to ensure compliance with UAE regulations and the OECD Transfer Pricing Guidelines.