Setting up a mainland company in the UAE offers unique advantages, especially for businesses that require direct access to the local market or wish to secure government contracts. Unlike free zone companies, mainland entities can operate freely within the UAE, with no geographical restrictions, providing greater flexibility in reaching local clients and expanding business networks with both public and private sectors.

The UAE has made substantial reforms to support mainland company formation, including lifting requirements for local sponsorship in certain sectors, making it more accessible for foreign investors to hold 100 percent ownership in various industries.

Common types of businesses include Limited Liability Companies (LLCs), branches of foreign companies, sole establishments, and civil companies for professional services. Each type has distinct legal, financial, and ownership requirements, tailored to different sectors and business needs. For example, an LLC is a popular choice for foreign investors due to its limited liability feature and new regulations allowing 100 percent foreign ownership in many sectors. Meanwhile, professional services firms often opt for a sole establishment, which enables specialized service delivery within the mainland with greater autonomy.

Starting a business in the UAE mainland requires adhering to specific regulatory frameworks, including:

- Company licensing;

- Compliance with labor laws; and,

- Alignment with local tax policies.

Business owners must secure approvals from various government entities, such as the Department of Economic Development (DED) in the respective emirate and may need to meet requirements for industry-specific certifications or permits. Compliance with Emiratization quotas (for certain businesses) and the UAE’s Value-Added Tax (VAT) laws is also essential. The government has streamlined these processes considerably in recent years, making registration and licensing simpler and more transparent, with many services available online.

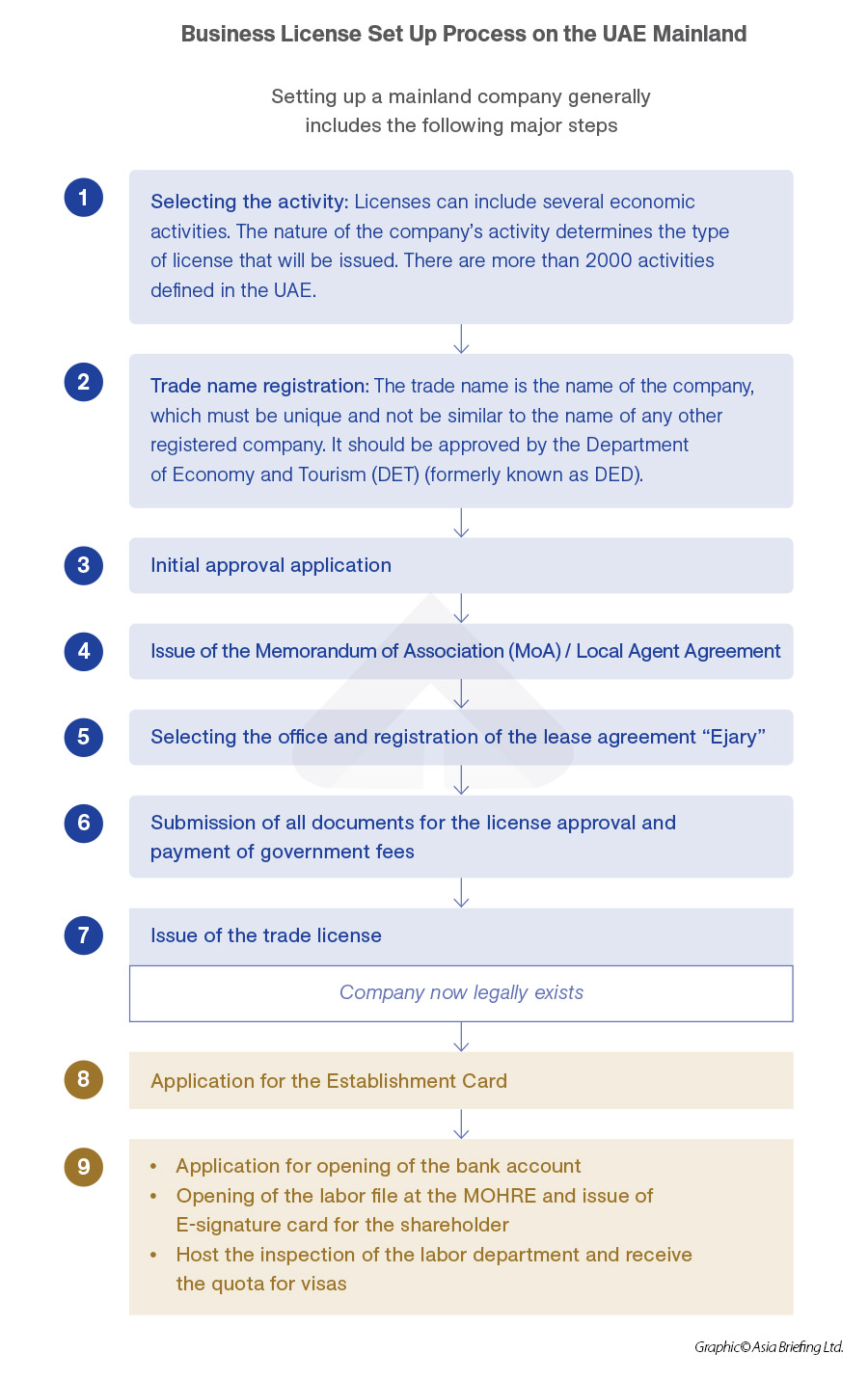

Step-by-step guide to setting up a company in Mainland UAE

Establishing a company in the UAE mainland requires a structured approach to ensure compliance with local laws and alignment with business goals.

Step 1: Choosing your business activity

The first and crucial step in setting up a mainland company in the UAE is identifying the core business activity your company will pursue. The UAE Department of Economic Development (DED) classifies business activities into various categories, including:

- Commercial (e.g., trading and retail operations)

- Industrial (e.g., manufacturing and production)

- Professional (e.g., consulting, legal, and technical services)

The business activity you select determines the type of license issued, along with the regulations and compliance requirements applicable to your business.

The UAE offers over 2,000 distinct business activities to choose from, providing flexibility for diverse sectors and enterprises. Additionally, businesses can sometimes engage in multiple activities under a single license if they are closely related, offering flexibility to grow and adapt.

Step 2: Selecting a business structure

Once you have defined your business activity, the next step is choosing the legal structure that best suits your operational goals and regulatory needs. The UAE mainland offers several business structures, each with specific advantages, ownership requirements, and compliance obligations. The primary structures include:

- Limited Liability Company (LLC): Ideal for businesses seeking a flexible structure that allows for limited liability and protection of personal assets. LLCs can now be 100 percent foreign owned in many sectors.

- Sole Proprietorship: Suitable for professionals and entrepreneurs who want full control and ownership of the business, often used for consultancy and service-based businesses.

- Branch Office: Allows an international company to expand its presence into the UAE while operating under its parent company’s name.

- Joint Stock Company: Typically suitable for larger companies, this structure allows businesses to raise capital through public or private stock issuance.

- Professional Services Company: Often chosen by professionals like doctors, engineers, and consultants, this structure allows 100 percent ownership by the professional, although it may require a local service agent.

When choosing a structure, consider factors such as liability exposure, ownership preferences, scalability, and the nature of your business.

For instance, an LLC is a popular choice due to its versatility, while a sole proprietorship may be preferable for independent professionals aiming for streamlined operations.

Step 3: Trade name reservation

With your business activity and structure defined, the next step is to choose and reserve a trade name for your company. A trade name serves as your business's identity and differentiates it from others in the market. The trade name must align with the UAE’s naming conventions, which include the following requirements:

- The trade name must be original and cannot duplicate or closely resemble the name of an existing registered company.

- The trade name should reflect the nature of the business and its legal structure (e.g., “LLC” for Limited Liability Companies).

- The name must avoid any references to religion, governing bodies, or words that could violate public morals or order.

The trade name registration process is facilitated by the Department of Economic Development (DED) in the respective emirate. The application can be submitted through the DED where businesses receive a transaction number or payment voucher to track and complete the reservation. Once approved, trade names are renewable, securing the business’s identity within the UAE.

Step 4: Initial approval from the Department of Economic Development (DED)

The initial approval from the Department of Economic Development (DED) indicates that the UAE government has no objection to the formation of your business. However, it’s important to note that this approval does not authorize business operations yet; it simply permits the company to move forward with the legal setup steps.

To obtain this initial approval, you must submit certain documents, including:

- Completed application form for initial approval

- Passport copies of all shareholders and managers

- Any other permits or approvals required for specific business activities (e.g., legal, security, or financial services)

Foreign investors may also need clearance from the General Directorate of Residency and Foreigners’ Affairs. Additionally, some industries, such as those dealing with legal or security matters, require specific governmental endorsements before moving on to this step. The initial approval demonstrates the government’s green light to proceed with the company setup, making it an essential step that validates the company’s intended business activity and proposed ownership structure.

Step 5: Preparing legal documents

Once the initial approval is secured, the next step is to prepare the necessary legal documents, which help establish the company’s official standing in the UAE. The essential documents typically include:

- Memorandum of Association (MOA): The MOA outlines the business’s foundational principles, specifying the roles, responsibilities, and ownership rights among shareholders. This document is essential for legal structures like Limited Liability Companies (LLCs), Public Joint Stock Companies (PJSCs), Private Joint Stock Companies (PrJSCs), and Limited Partnerships. Drafting and attestation of the MOA should be done through UAE law firms, courts, or a notary public to ensure accuracy and compliance.

- Tenancy contract (Ejari): UAE regulations require businesses to have a registered physical location. This contract serves as proof of the business’s official address, typically attested through the Land Department portal (in Dubai) to verify compliance with tenancy laws.

- Passport copies and photographs of shareholders: Shareholders must provide identification, including passport copies and recent photographs, to support legal documentation.

Step 6: Securing office space

In the UAE mainland, every business must have a physical office location that complies with DED guidelines and local zoning laws. Choosing a suitable office space not only meets regulatory requirements but can also influence the business’s operational efficiency and accessibility to clients.

After finalizing an office location, businesses must register the tenancy contract through the Land Department portal (in Dubai), which acts as a regulatory measure to track commercial leases. This registration provides the business with an Ejari certificate, which is essential for obtaining the trade license. Proper registration of office space signals compliance with UAE business laws and confirms that the business has a legitimate and traceable location within the emirate.

Step 7: Obtaining additional approvals

For certain business sectors, securing initial approval from the Department of Economic Development (DED) is only the beginning. Some industries require additional clearances from specific regulatory authorities, depending on the nature of the business activities. These additional approvals ensure that businesses meet industry-specific standards and comply with UAE regulations.

Examples of sectors requiring further approvals include:

- Healthcare: Requires clearance from local health authorities, such as the Dubai Academic Health Corporation (Dubai Health) or the Ministry of Health and Prevention, to ensure adherence to health and safety standards.

- Education: Institutions and educational services must obtain approval from the Ministry of Education and local educational bodies to comply with curriculum and staffing regulations.

- Legal Services: Law firms and legal consultancies require approval from the Ministry of Justice.

- Telecommunications: Companies in telecommunications need clearance from the Telecommunications and Digital Government Regulatory Authority (TDRA).

- Tourism and Hospitality: Travel agencies, hotels, and tourism operators must seek approval from local tourism departments and the Executive Council, depending on the emirate.

Step 8: Submitting the application for a Business License

After obtaining initial approval and any necessary additional clearances, the next step is to apply for a business license from the DED. The DED requires several documents for this application, including:

- Confirmation of initial approval and previous application documents;

- RERA-attested lease agreement copies (Dubai properties);

- Notarized memorandum of association (all company types);

- Relevant governmental department approvals, where applicable; and,

- Service agent requirements:

- Notarized service agent contract

- Mandatory for civil establishments

- Required for companies fully owned by non-GCC nationals

- Must involve a UAE local service agent

These documents must be submitted to the DED either through physical service centers . Each license type may have specific requirements, so verifying details with DED guidelines can ensure accuracy in submissions.

Step 9: Paying fees and receiving the Business License

Once the application is approved, the final step involves paying the associated fees and obtaining the official business license. The cost of setting up a business in the UAE mainland includes various fees, such as trade license fees, government approvals, and Ejari registration costs. These fees vary depending on the license type, the business activity, and the emirate where the company is established.

- After submitting your application, you will receive a payment voucher detailing the required fees. Payment must be made within 60 days to avoid cancellation of the application.

- Upon completing the payment, the DED issues the business license. You can collect the license from the DED’s service centers or download it through their online platform.

Step 10: Post-license activities

Once your business license has been issued, a few essential post-license activities are required to ensure your business is fully operational and compliant. This step involves integrating your business into the local commercial ecosystem and setting up the necessary infrastructure to manage finances and human resources.

Opening of Establishment card:

Along with the standard documents, you will also need to apply for an Establishment Card. This card is issued by the Immigration Authority of the Emirates and is essential for businesses that intend to hire employees, as it provides a unique identification number required for visa applications and labor compliance.

The documents required for the Establishment Card typically include:

- The trade license copy;

- Memorandum of Association (MOA); and,

- Passport copies and other identification documents of the business owners.

- Mobile number and Email ID

Registering with the Chamber of Commerce

Registration with the UAE Chamber of Commerce is a crucial step following the issuance of a business license. Membership with the Chamber offers a range of benefits, including access to business networks, trade resources, and support services that can enhance your company's operations. Additionally, Chamber membership enables companies to participate in international trade fairs, seminars, and events, offering valuable networking opportunities and resources to aid in growth and expansion.

Each emirate has its own Chamber of Commerce, and the registration process varies slightly by location. Generally, businesses need to submit the following:

- A copy of the business license

- The Memorandum of Association (MOA)

- Identification documents of company owners and managers

- A completed registration form with relevant fees

Once registered, the company receives a Chamber membership certificate, affirming its legitimacy and enabling it to participate in various Chamber-led business initiatives and programs.

Opening a corporate bank account

A corporate bank account is essential for managing your company’s finances, facilitating transactions, and processing payroll. The UAE banking sector is robust, with a wide array of local and international banks offering tailored business account options for various business sizes and sectors. Choosing the right banking partner and account type depends on factors like transaction volume, international banking needs, and account maintenance fees.

To open a corporate account, most banks require the following documents:

- A copy of the business license

- MOA and shareholding agreements

- Passport copies of shareholders and authorized signatories

- Proof of business address (Ejari certificate if in Dubai)

- Board resolution authorizing the account opening (if applicable)

- Valid UAE Residence Proof

Some banks may request additional details, especially for businesses owned by non-UAE nationals. Banks typically conduct due diligence checks to verify business legitimacy and compliance with UAE regulations. Once approved, the account is ready for use, allowing the business to handle day-to-day financial transactions securely.

Opening of the labor file and issuance of the e-Signature card

To manage employee visas and other labor-related activities, businesses in the UAE must open a Labor File with the Ministry of Human Resources and Emiratisation (MOHRE). This file serves as the official record of the company’s employment and labor status. Additionally, for companies fully owned by non-UAE nationals, a mandatory E-Signature Card is required for the shareholders. This card functions as an electronic signature for employment and immigration-related applications, streamlining compliance and approvals with government agencies.

The E-Signature Card application typically involves:

- Submission of passport copies and other identification documents for shareholders

- Company’s trade license and Establishment Card copies

Hosting the Labor Department inspection and receiving the visa quota

Following the opening of the labor file, companies may be subject to an inspection by the UAE Labor Department to ensure compliance with workplace regulations and health and safety standards. This inspection is a standard regulatory measure that confirms the company’s legitimacy and adherence to labor laws.

Upon successful completion of this inspection, the business will receive an approved visa quota from MOHRE, which specifies the number of work visas allocated for the company. This quota allows companies to manage their staffing needs based on business requirements and is essential for applying for employee visas as the business expands.