Understanding Free Trade Zones in the UAE

The UAE’s Free Trade Zones (FTZs) are designated areas where companies benefit from tax exemptions, simplified business regulations, and 100 percent foreign ownership—privileges not typically available in mainland UAE. Businesses operating within these zones enjoy various incentives, including duty-free imports and exports, relaxed regulatory requirements, and the ability to repatriate profits in full, making FTZs particularly attractive for foreign entrepreneurs and multinational corporations alike.

Historically, the UAE launched its first free zone, the Jebel Ali Free Zone (JAFZA), in the 1980s, which quickly became a successful economic hub and model for future free zones across the UAE. The creation of FTZs helped the UAE diversify away from an oil-based economy, focusing instead on trade, logistics, finance, and innovation.

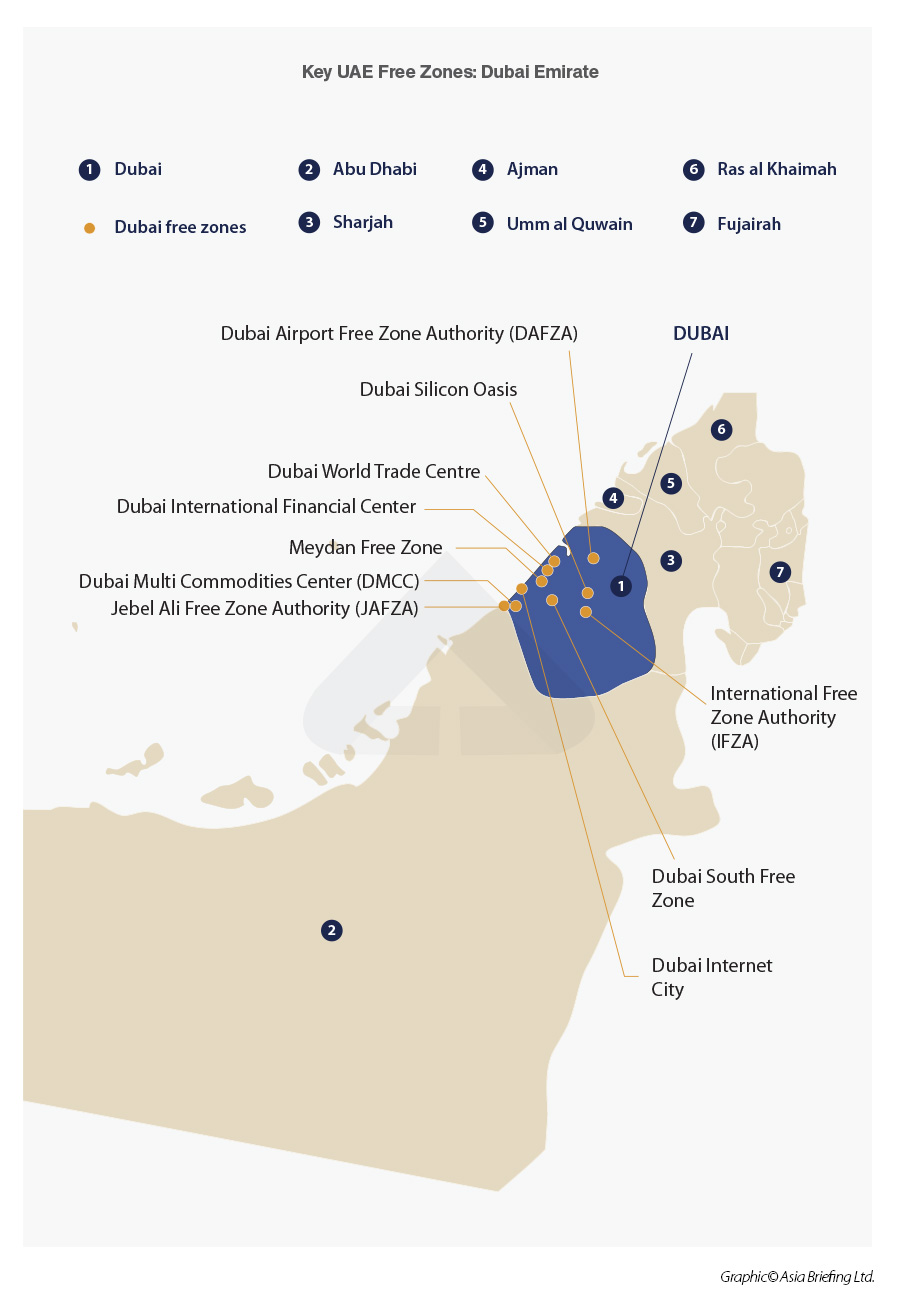

Today, there are over 40 free zones spread across all seven emirates, each offering a unique environment tailored to different industries and business activities. These zones now play a vital role in the UAE’s economy, contributing significantly to GDP, job creation, and the country's position as a global trade and investment hub.

There are six types of licenses available in the UAE Free Zones, namely:

- General trading license;

- Trading/Commercial license;

- Services license;

- Manufacturing license;

- Warehousing license; and,

- Industrial license.

Types of Free Zones

The UAE’s free zones cater to various business needs and industry sectors, broadly categorized into commercial, industrial, and professional FTZs. Each type is strategically designed to support specific business activities and sectors, offering relevant infrastructure, regulatory support, and incentives.

- Commercial Free Zones: These zones primarily support trading activities and logistics. An example is the Dubai Multi Commodities Centre (DMCC), which serves as a global marketplace for commodities such as gold, diamonds, and tea. DMCC attracts businesses involved in trade and provides an ideal platform for companies to engage in international commerce with streamlined trade facilitation services and a robust logistics network.

- Industrial Free Zones: These zones are tailored for manufacturing, warehousing, and distribution activities. Jebel Ali Free Zone Authority (JAFZA) is a notable industrial free zone that accommodates heavy industries and large-scale manufacturing operations. Positioned near Jebel Ali Port, the busiest port in the Middle East, JAFZA provides businesses with unparalleled access to regional and international markets, making it ideal for companies in the manufacturing and distribution sectors.

- Professional and Technological Free Zones: These FTZs focus on fostering innovation, technology, and professional services. Dubai Silicon Oasis, for example, is a free zone designed to support technology-driven businesses and startups, providing a state-of-the-art infrastructure for companies in sectors such as tech, R&D, and software development. The zone offers special licensing packages and support for tech-focused companies, positioning itself as a hub for digital transformation within the UAE and beyond.

Other specialized free zones include media-focused zones like Dubai Media City, which attracts media and advertising firms, and healthcare-specific zones such as Dubai Healthcare City, aimed at supporting medical services and research.

|

Popular Free Zones in UAE |

|||

|

Free Zone |

Notable Features |

Popular License Types |

Industries/Activities |

|

Dubai Multi Commodities Centre (DMCC) |

Ideal for trading and consulting companies |

General Trading License |

Commodities, Precious Stones, Metals |

|

Popular with precious stones and metals |

Trading/Commercial License |

||

|

Service License |

|||

|

Jebel Ali Free Zone (Jafza) |

First UAE free zone, offering a vast territory |

Manufacturing License |

Logistics, Oil and Gas, Trading, Manufacturing |

|

Well-developed infrastructure with a large seaport |

Warehousing License |

||

|

Industrial License |

|||

|

Dubai Silicon Oasis (DSO) |

High-tech hub supporting start-ups and tech firms |

Trading/Commercial License |

Technology, Engineering, Consulting, Call Centers |

|

Offers payment installment options |

Service License |

||

|

Industrial License |

|||

|

Ajman Free Zone Authority (AFZA) |

Affordable set-up with flexible payment plans |

General Trading License |

Trading, Small Businesses, Professional Services |

|

Easy visa options |

Warehousing License |

||

|

Service License |

|||

|

Hamriyah Free Zone |

Seaport access with warehousing options |

Warehousing License |

Oil and Gas, Logistics, Manufacturing, Trading |

|

Attracts businesses in oil, gas, and manufacturing |

Industrial License |

||

|

Service License |

|||

Benefits of setting up in an FTZ

- Exemptions from import and export duties, allowing cost-effective movement of goods.

- Freedom to transfer profits and capital abroad without restrictions.

- No foreign exchange controls, providing financial flexibility for investors.

- No need for a local Emirati partner, granting full control over the business.

- Streamlined registration and reduced paperwork requirements.

- Faster company formation, allowing for quicker market entry and operations.

- FTZs operate under flexible, dedicated laws and regulations.

- Reduced compliance burden, allowing companies to focus more on growth.

- Proximity to major transport hubs (ports, airports, highways) for easy regional and global market access.

- Ready-made offices, factories, and warehouses, as well as customizable leasing or purchase options.

- High-speed connectivity and advanced business centers.

- Cost-effective logistics and distribution solutions, especially in zones like Jebel Ali Free Zone (JAFZA).

- Access to consultancy, legal services, and efficient immigration processing.

- Networking opportunities within vibrant business communities in each free zone.

- Affordable sponsorship and recruitment options for skilled labor, with liberal employment policies for expatriates.

Steps to set up a company in an FTZ

Choose the right type of business activity

Free zones offer various business licenses, such as commercial, consultancy, industrial, and media, based on activity type. Select an activity that aligns with the free zone’s primary focus, ensuring access to relevant resources and markets.

Select an appropriate Free Trade Zone (FTZ)

Each free zone has a unique industry focus (e.g., DMCC for commodities, Dubai Media City for media). Consider proximity to key markets, infrastructure, and specialized resources to support your business needs.

Determine the Legal Structure

Choose between Free Zone Establishment (FZE) or Free Zone Company (FZ LLC), depending on the number and type of shareholders. Verify that the selected free zone supports your desired structure, as some free zones offer specific formats.

Apply for the required Business License

License types are aligned with business activities, including trade, services, or industrial. Some free zones offer specialized licenses, such as eCommerce or innovation licenses, to accommodate various business models.

Select a trade name

Ensure the trade name adheres to UAE regulations (e.g., not containing offensive words or religious references). Verify the name’s availability through the respective free zone authority or the Department of Economic Development (DED).

Prepare required documents

Typical documentation includes passport copies of shareholders, a business plan, and proof of residency. Additional documents, such as financial reports and no-objection certificates, may be required based on business structure and activity.

Submit the company setup application

Complete and submit the application form through the free zone’s portal, adhering to any specific instructions for the selected free zone. Obtain initial approvals before finalizing registration.

Pay fees and meet capital requirements

Application and registration fees vary by free zone and type of license. Certain free zones have minimum capital requirements, which may depend on the business activity (e.g., AED 50,000 for DMCC).

Choose an office solution

Free zones provide flexible options like shared workspaces, flexi-desks, or dedicated office units. Warehousing and factory spaces are available for industries needing specialized facilities.

Establish a physical business address

A physical address in the free zone is often required for regulatory compliance. Securing office space solidifies your company’s presence in the UAE and enables visa sponsorship for employees.

Post-setup considerations

Opening a Corporate Bank Account

Setting up a corporate bank account in the UAE is a critical post-setup step for any business. Establishing a corporate bank account in the UAE requires a well-prepared application with specific documents. Generally, you’ll need:

- Company trade license and registration documents

- A business plan or a brief description of the company’s activities

- Identification documents of shareholders and authorized signatories

- An office lease agreement, as many banks require proof of a physical address

The process may differ slightly by bank, but UAE financial institutions are well-versed in handling foreign-owned business accounts, often offering advisory services to facilitate the account setup.

A corporate bank account is essential for efficient cash flow management and regulatory compliance. It offers transparency, allows efficient handling of transactions, and ensures that business finances are organized separately from personal accounts. Moreover, using a UAE-based account can simplify payment processing with local clients and suppliers and provide access to additional banking services, such as financing and currency exchange.

Visa regulations and employee sponsorship

As part of establishing a UAE-based company, foreign business owners must navigate visa requirements for themselves and their employees.

The visa requirements vary depending on the owner’s role and the number of employees the company plans to sponsor. Typically, UAE Free Trade Zones provide assistance with visa applications as part of their service offerings, but each FTZ has specific rules. Most FTZs issue two main types of visas:

- Investor Visa: For business owners or investors

- Employment Visa: For staff members and sponsored employees

Each visa type requires the submission of specific documents, such as a copy of the business license, medical reports, and passport copies.

After obtaining preliminary approval, applicants undergo a medical test and submit the necessary documents, after which the residency visa is issued. This visa allows employees and business owners to live in the UAE and travel in and out freely, offering convenience and flexibility for running their operations.