The concept of excise tax, a form of indirect tax on specific goods, was introduced in the United Arab Emirates (UAE) with the purpose of both promoting public health and increasing government revenue.

This tax specifically targets products that are deemed harmful to human health or the environment, such as tobacco, sugary drinks, and energy drinks. Since its introduction, the excise tax has generated significant revenue for the UAE government, which has been reinvested into health and infrastructure projects. This revenue stream allows the government to cover healthcare costs associated with treating diseases caused by high sugar and tobacco consumption. Simultaneously, it discourages the consumption of these products by raising their retail prices, encouraging citizens and residents to make healthier choices.

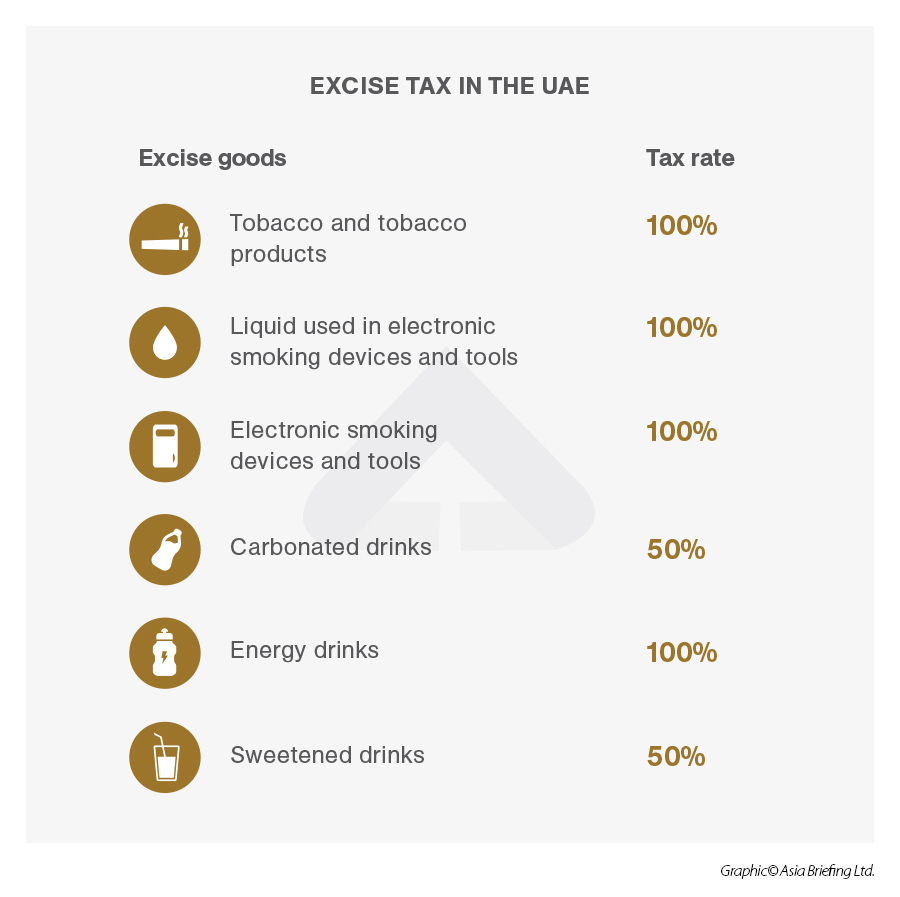

Goods subject to excise tax in the UAE

The UAE's excise tax applies to specific categories of goods that pose health risks to consumers or contribute to environmental harm. Known as "excise goods," these items are subject to higher tax rates to discourage their consumption and promote healthier living choices. Below, we examine each category currently included under the UAE’s excise tax framework and the specific goods covered within each.

Tobacco and tobacco products

Tobacco products, defined by the GCC Common Customs Tariff’s Schedule 24, include cigarettes, cigars, and various forms of smokeless tobacco such as chewing tobacco, snuff, and other alternatives.

Carbonated drinks

The category of carbonated drinks encompasses any aerated beverage, excluding plain, unflavored sparkling water. This category includes all forms of carbonated soft drinks and their concentrated forms—powders, gels, or extracts used to prepare such beverages. These drinks contribute significantly to sugar intake, which is linked to obesity, diabetes, and other chronic health conditions.

Energy drinks

Energy drinks, including those marketed with stimulants such as caffeine, taurine, ginseng, and guarana, are another excise category. This also includes concentrates, powders, and gels formulated to be mixed into energy beverages. Energy drinks are associated with increased health risks due to their high levels of caffeine and other stimulants, which may contribute to cardiovascular issues and increased stress levels.

E-cigarettes and related products

As part of the UAE’s effort to keep pace with evolving consumption patterns, electronic smoking devices, their components, and liquids (both nicotine and non-nicotine-based) were added to the excise tax list in December 2019. E-cigarettes and vaping products were taxed following research linking them to various respiratory and cardiovascular health risks.

Sweetened beverages

In addition to the products listed above, the UAE expanded excise taxes to cover sweetened beverages in 2019. This includes any drink with added sugar or other sweeteners, whether in ready-to-drink form or concentrates (such as powders and gels). However, certain exceptions exist; beverages with at least 75 percent milk content, baby formula, and products for special medical or dietary needs are exempt to encourage healthy nutritional options.

Excise tax rates

The UAE’s excise tax framework assigns specific tax rates to certain categories of goods, aiming to reduce their consumption due to their harmful effects on health and, in some cases, the environment. The rates are tiered, reflecting the varying degrees of health risks associated with each product. Here, we break down the applicable excise tax rates and explain the rationale behind these rates.

Tax rates by product category

|

Product category |

Excise tax rate |

Description |

|

Tobacco and Tobacco Products |

100% |

Includes cigarettes, cigars, and smokeless tobacco products; high tax rate due to significant health risks, aimed at discouraging smoking. |

|

Energy drinks |

100% |

Applies to energy drinks containing stimulants like caffeine and taurine, including concentrates and powders; high tax rate reflects health risks and aims to reduce consumption. |

|

Electronic smoking devices & liquids |

100% |

Covers e-cigarettes, vaping devices, and associated liquids (with or without nicotine); intended to curb rising use due to health concerns similar to tobacco products. |

|

Carbonated drinks |

50% |

Includes all aerated beverages (excluding plain sparkling water) and their concentrated forms; moderate tax to address long-term health issues like obesity and diabetes. |

|

Sweetened beverages |

50% |

Encompasses drinks with added sugar or sweeteners, including sodas and sweetened concentrates; aims to reduce sugar intake, with exemptions for certain milk-based and dietary items. |

Registration and compliance requirements for Excise Tax

To effectively manage the excise tax system and ensure compliance, the UAE government mandates registration for certain business entities engaged in excise-related activities. Compliance is key to both avoiding penalties and supporting public health initiatives, as excise tax aims to reduce the consumption of products harmful to health.

Who must register?

Businesses that deal directly with excise goods are required to register with the Federal Tax Authority (FTA). These entities include:

- Importers: Companies that import excise goods, such as tobacco or carbonated drinks, into the UAE must register for excise tax.

- Manufacturers: Businesses that produce excise goods for domestic consumption are also subject to registration requirements.

- Stockpilers: Entities that stockpile excise goods for business purposes and cannot demonstrate that excise tax has been previously paid must register. Stockpilers are essentially those holding large quantities of excise goods, potentially for resale, without prior tax clearance.

- Warehouse keepers: Any party responsible for overseeing designated excise warehouses or zones within the UAE must also register with the FTA.

Registration process

Registering for excise tax is a straightforward process designed to ensure all qualifying businesses meet legal and fiscal responsibilities:

- Businesses must first create an account on the Federal Tax Authority’s website.

- Through the FTA’s e-services portal, businesses can access various resources, including the Excise Tax Registration User Guide.

- The online registration form will require details about the type of excise goods handled and relevant business activities, such as production, importation, or warehousing.

- After submitting the required information, businesses must await FTA approval. Upon approval, they are granted a tax registration number, which enables them to begin reporting and remitting excise tax.

Compliance with excise tax regulations is crucial for all registered entities to avoid legal and financial repercussions.

Taxes must be paid in full by the deadline to avoid penalties. The FTA provides the EmaraTax platform, which simplifies filing, payment, and other tax-related processes. The FTA actively monitors compliance, conducting audits and enforcing penalties for any business found evading or underreporting excise tax obligations.

Filing and payment obligations

Tax return filing

Businesses registered for excise tax must submit their returns by the 15th day of the month following the end of each tax period. The return provides details on the amount of excise tax due and ensures that the business remains compliant with UAE tax laws. Returns must be filed monthly, and this deadline is strictly enforced.

Required documentation for compliance

To ensure accurate and timely filing, businesses must maintain proper records of their excise goods. The required documents for compliance depend on the nature of the business's activities but typically include:

- Excise Tax Import Declaration Forms: For businesses involved in importing excise goods into the UAE.

- Production Declaration Forms: For businesses that produce excise goods.

- Designated Zone Reporting Forms: These forms are necessary for businesses that store or release excise goods from designated zones, whether customs clearance is involved.

- Deductible Excise Tax Declaration Forms: If applicable, these forms help businesses deduct excise tax in line with legal requirements.

- Production, importation, or stockpiling records.

- Export records and evidence.

- Stock level details, including lost or destroyed items.

- Tax records for due excise tax on imports, production, and stockpiling.

Businesses must ensure that the information provided in these forms is accurate and reflects their excise tax liabilities.

After filing the excise tax return, businesses are required to make payment to the FTA. Payment should be completed by the due date, which is the 15th of each month, to avoid penalties. The FTA (Federal Tax Authority) simplifies the filing process by offering an online platform called EmaraTax. This platform allows businesses to file returns, register, pay taxes, and request refunds with several payment methods.

Payment methods

The FTA offers various methods for businesses to pay their excise tax obligations. Payment can be made using the following options:

- e-Dirham: A government-backed payment system that allows businesses to pay taxes through an electronic wallet.

- Credit Card: Businesses can also use credit cards to make payments via the EmaraTax platform.

- Bank Transfer: Businesses can choose to transfer funds directly from their bank accounts to settle their excise tax dues.

Once payment is made, it will be recorded in the Transaction History section within the My Payments tab on the EmaraTax platform.

Consequences of non-compliance

Failure to comply with filing deadlines or payment obligations can lead to severe consequences, including penalties and interest charges. The FTA monitors compliance closely, and businesses that fail to file their returns or make payments on time may face late fees. Furthermore, businesses that consistently miss deadlines or fail to pay may be subject to audits, which could result in additional penalties or legal action.

Impact on businesses and consumers

For businesses involved in the import, production, or sale of excise goods, the tax has prompted significant changes in day-to-day operations. The excise tax affects businesses in several key areas:

Changes in pricing strategies due to tax burden

As excise tax rates are applied directly to the cost of goods, businesses face pressure to adjust their pricing models. The tax burden is often passed onto the consumer, resulting in higher prices for excise goods such as tobacco, soft drinks, and energy drinks. In some cases, businesses may opt to reduce their profit margins to remain competitive or absorb part of the cost themselves, but this is not always sustainable in the long run.

In competitive markets, where price sensitivity is high, businesses may struggle to raise prices without losing customers. As a result, companies often adjust their pricing strategies carefully to avoid losing market share while ensuring compliance with excise tax regulations.

Compliance costs associated with registration and reporting

The administrative aspects of excise tax compliance can also be costly for businesses. Registration with the FTA is mandatory for companies involved with excise goods, and they must file monthly returns detailing the tax due. This requires businesses to invest in accounting systems or hire external consultants to ensure accurate reporting and timely submission.

Additionally, the cost of ensuring compliance with record-keeping requirements can add up. Maintaining detailed records of transactions, inventory, and tax liabilities demands resources and time, particularly for smaller businesses that may not have the capacity to dedicate staff to these tasks.

Consumer behavior changes

The introduction of excise tax also significantly impacts consumer behavior. By increasing the price of harmful products, the tax is designed to discourage consumption and promote healthier alternatives. Consumers, faced with higher prices for items like sugary drinks or tobacco, may choose to reduce their consumption of these goods or switch to less expensive, non-taxed alternatives.

- As the prices of excise goods rise, many consumers are more likely to explore healthier alternatives. For example, the sugar tax has already shown a shift toward healthier beverages, with more consumers opting for water, fresh juices, or sugar-free drinks in place of sugary sodas. Similarly, as the price of tobacco products rises, some smokers may consider quitting or switching to e-cigarettes, which may or may not be subject to similar tax rates.

- While the tax encourages healthier choices, the higher prices may also lead to a shift in consumer preferences towards lower-cost substitutes. In cases where excise goods are seen as non-essential luxuries, consumers may cut back on their consumption entirely or seek alternatives that are less taxed, thus reducing overall market demand for these products.

Overall impact on market demand for taxable goods

The cumulative effect of excise tax is a decrease in market demand for taxable goods. Higher prices, along with the growing trend of health-consciousness, make these goods less attractive to a significant portion of the population. Businesses that depend heavily on the sale of excise goods, such as tobacco manufacturers or beverage producers, may see a decline in sales volumes as consumers seek alternatives or reduce their consumption.

However, the full impact on demand can vary depending on the elasticity of the product. Essential products with fewer substitutes, such as cigarettes, may see a smaller reduction in demand, while products like sugary beverages may experience a larger drop as consumers switch to healthier options.

Historical context

The introduction of excise tax on October 1, 2017, was the UAE’s first significant step toward a broader fiscal framework focused on health-related taxation. This initial rollout set a tax rate of 50 percent on carbonated beverages and 100 percent on tobacco products and energy drinks. By establishing these rates, the government aimed to discourage consumption through higher prices, making these goods less accessible and attractive to consumers.

In December 2019, the UAE government expanded the excise tax’s scope to include sweetened beverages, electronic smoking devices, and their associated liquids. This adjustment followed increased awareness of the health impacts of sugar consumption, linking excessive intake to obesity, diabetes, and other chronic conditions prevalent in the UAE.

Excise tax in comparison with VAT

The excise tax, unlike the UAE’s other major indirect tax, the Value-Added Tax (VAT), is targeted at specific goods rather than being a broad-based tax on all consumer products. Introduced in January 2018 at a standard rate of 5 percent, VAT applies across a wide range of goods and services, contributing to the country’s revenue while being less specific in purpose than excise taxes. While VAT supports general revenue generation for public services, excise tax serves a dual function: generating revenue and directly addressing public health issues by discouraging the consumption of unhealthy products.

In essence, excise tax and VAT complement each other within the UAE’s tax framework. VAT broadens the government’s fiscal base, while excise tax targets specific behaviors, helping to shape a health-conscious society and reduce public health burdens.