Closing a business without full compliance can lead to potential complications, ranging from fines to legal disputes. The UAE has specific regulations governing the business closure process, varying depending on the type of business entity (such as LLCs, branches, or free zone companies) and location within the UAE (mainland or free zones).

A well-structured closure process ensures that all obligations to creditors, employees, landlords, and government entities are addressed, which ultimately safeguards a business owner’s reputation and financial interests. For those unfamiliar with the procedural requirements, working with legal or business consultants experienced in the UAE’s regulatory landscape is often advisable to avoid delays or additional costs.

Business owners who neglect their legal responsibilities may find themselves blacklisted by UAE authorities, jeopardizing their ability to return to the UAE or engage in future business activities within the region.

Addressing every aspect of the closure process—from finalizing employee contracts to cancelling visas and licenses—can help prevent these challenges. Additionally, adhering to regulatory guidelines provides peace of mind, knowing that the business has been legally dissolved without lingering responsibilities or repercussions.

Reasons for closing a business

- Companies in the UAE often decide to shut down due to financial hardships including liquidity issues, mounting debts, and insufficient revenues, compounded by market fluctuations, changing consumer preferences, and poor cash flow management.

- The UAE's dynamic and globally interconnected economy subjects’ businesses to rapid market shifts, including increased competition, fluctuating commodity prices, and evolving consumer preferences, which can significantly impact business viability.

- Business owners or investors may choose to close operations when market conditions no longer align with their vision, ownership changes occur, or resource reallocation becomes necessary for higher-growth regions.

- The continuous evolution of UAE's regulatory framework, encompassing legal, labor, and financial obligations, can create compliance burdens that some businesses find too costly or complex to maintain, ultimately leading to closure decisions.

Legal framework for business closure

At the heart of the UAE's business closure regulations lies Federal Decree-Law No. 32 of 2021 on Commercial Companies, which replaced the previous Federal Law No. 2 of 2015. This modernized legislation reflects the UAE's commitment to maintaining a robust yet flexible business environment. Complementing this framework is Federal Law No. 9 of 2016 (the Bankruptcy Law), amended by Federal Law No. 23 of 2019, which provides specific provisions for handling business insolvency.

Voluntary liquidation offers a straightforward route for solvent companies choosing to cease operations for strategic reasons. This process requires shareholders' approval through a notarized resolution and, crucially, a Declaration of Solvency confirming the company's ability to settle all debts within 12 months. Following this declaration, companies must undergo a 45-day public notice period before final deregistration.

In contrast, bankruptcy proceedings cater to businesses facing financial distress. The law mandates companies to file for bankruptcy if they've defaulted on payments for over 30 consecutive business days or when assets become insufficient to cover liabilities. Creditors can also initiate proceedings if unpaid debts exceed AED 100,000 and remain outstanding for more than 30 days after formal demand.

The scope of these regulations extends beyond mainland companies to include most free zone entities, though notably excluding the Dubai International Financial Centre (DIFC) and Abu Dhabi Global Market (ADGM), which operate under their own legal frameworks. Government-owned enterprises enjoy special considerations, with the option to opt into bankruptcy law application through their constitutional documents.

Recent amendments to these laws reflect the UAE's responsive approach to global business challenges. For instance, during the COVID-19 pandemic, the government introduced temporary measures to provide struggling businesses with greater flexibility in restructuring options. These adaptations demonstrate the UAE's commitment to maintaining a business-friendly environment while ensuring proper market regulation.

The distinction between voluntary and compulsory liquidation lies not just in their triggers but in their procedural requirements and outcomes. While voluntary liquidation typically allows for a more controlled and dignified exit, compulsory liquidation through bankruptcy proceedings involves court supervision and appointed trustees to protect creditor interests.

Initial steps in the closure process

The cornerstone of initiating a business closure lies in obtaining formal approval through appropriate corporate governance channels. For companies with multiple shareholders, this typically begins with a board resolution followed by a shareholders' extraordinary general meeting. This meeting must result in a special resolution, properly notarized, that explicitly states the intention to wind up the business. The resolution should outline the primary reasons for closure and establish a preliminary timeline for the process.

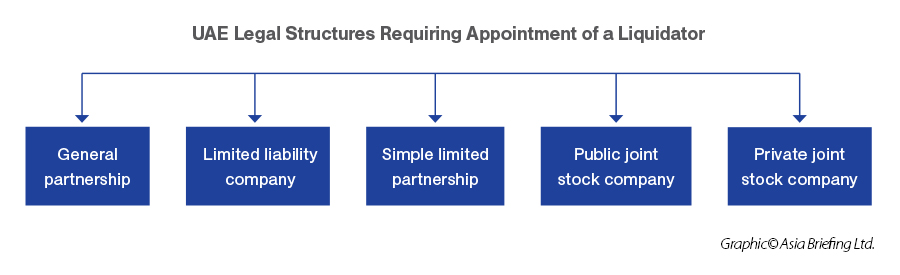

For certain business structures – including:

- Limited Liability Companies (LLCs),

- General Partnerships, and

- Public Joint Stock Companies (PJSCs) - appointing a qualified liquidator isn't just advisable; it's a legal requirement.

The liquidator, typically a licensed professional with expertise in corporate dissolution, assumes responsibility for overseeing the entire closure process, from asset valuation to debt settlement.

Even before the formal appointment of a liquidator, businesses must begin the process of documenting and organizing their financial affairs. This includes preparing comprehensive lists of assets and liabilities, gathering all relevant corporate documents, and initiating communication with key stakeholders. It's worth noting that maintaining transparent communication with employees, suppliers, and clients during this phase can significantly reduce complications later in the process.

Detailed steps for closing a Mainland business

Closing a mainland business in the UAE involves a structured process to ensure compliance with local regulations, including cancelling licenses, settling financial obligations, and managing employee terminations. This process is primarily managed through the Department of Economy and Tourism (DET) and includes specific documentation and procedural steps.

Step 1: License cancellation

The initial step in closing a business is to cancel the business license. This involves holding a general assembly meeting and obtaining a notarized resolution from the shareholders agreeing to the liquidation. The resolution should appoint an official liquidator, who must accept the appointment in writing. Following this, a cancellation application is submitted to the DET or an authorized service center. The DET then issues a liquidation certificate, confirming that the business is undergoing dissolution.

Once the liquidation certificate is issued, the company must publish a notice of liquidation in two local newspapers to inform creditors and other stakeholders. A 45-day grace period follows, during which creditors can file claims against the business.

Step 2: Application process through the Department of Economy and Tourism (DET)

The DET oversees the administrative aspects of company closures for mainland businesses. After publishing the liquidation notice, a declaration letter must be submitted by both the liquidator and the partners, confirming no outstanding claims or objections were raised during the grace period. Additionally, businesses may need to secure approvals from various government bodies depending on their industry.

To finalize the process, the company must cancel its establishment card with the Ministry of Human Resources and Emiratisation (MOHRE) and cancel visas for any foreign partners at the General Directorate of Residency & Foreigners Affairs (GDRFA). All required documents must be submitted through DET-approved channels, and relevant fees must be settled to complete the deregistration.

Step 3: Required documents

To complete the closure process, specific documents are needed, including:

- Notarized minutes of the general assembly meeting authorizing the liquidation.

- An official letter of appointment from the liquidator.

- Proof of published liquidation notice in two newspapers.

- A declaration letter from the liquidator and shareholders confirming no third-party objections.

- Liquidation report (.

- Clearance letters from utility providers, landlords, and other service providers.

These documents ensure that all aspects of the business’s legal and financial obligations have been addressed and are necessary for the DET to approve final deregistration.

Step 4: Settling financial obligations

To lawfully close a business in the UAE, it is essential to settle all outstanding financial obligations, including debts, taxes, and employee benefits. Businesses must ensure that all creditors have been paid and that there are no outstanding loans or financial commitments. Additionally, the business must settle any due taxes and comply with final tax filings, where applicable.

Settling employee benefits is also a critical part of financial closure. Under UAE labor laws, employees are entitled to end-of-service gratuity, notice period compensation, and any other contractual benefits. Addressing these obligations demonstrates compliance with local labor standards and helps maintain positive relationships with current and former employees.

Step 5: Employee termination procedures

Employee terminations must follow UAE labor laws, which require that proper notice be given to employees prior to termination. Upon termination, businesses must cancel all employee visas and work permits, which involves coordination with the GDRFA and MOHRE. The business must provide employees with termination letters, issue any required end-of-service payments, and settle outstanding wages to ensure compliance with UAE labor regulations.

These actions not only fulfill the company’s legal responsibilities but also help to avoid potential disputes or claims from employees after the business has closed.

Step 6: Utility and service cancellation

As part of the business closure, companies are required to cancel all utility services, including water, electricity, and telecommunications. Clearance letters, also known as No Objection Certificates (NOCs), must be obtained from relevant providers like DEWA or Etisalat, confirming that all accounts are closed and payments settled. Companies may also need to return leased equipment, terminate rental agreements, and cancel any additional service contracts with third-party vendors.

Detailed steps for closing a Free Zone business

Closing a business in a UAE free zone involves unique steps based on the policies of each free zone authority, such as the Dubai Multi Commodities Centre (DMCC) or Jebel Ali Free Zone Authority (JAFZA). The process includes license cancellation, fulfilling documentation requirements, settling financial obligations, and employee terminations. Here’s a detailed look at these steps:

Step 1: License cancellation

The process to close a free zone business starts with notifying the relevant free zone authority of your intent to close. Each free zone has its specific procedures; for example, DMCC requires submitting a closure application through its member portal, while JAFZA mandates notifying authorities three to six months in advance, depending on the facility type.

In DMCC, businesses may opt for different closure types based on their financial status:

- Summary Winding Up: For companies with no liabilities or those able to clear debts within six months. This requires a statement of solvency.

- Creditors’ Winding Up: Applied when a company intends to liquidate but has existing debts. This option requires notifying creditors and scheduling a meeting to discuss outstanding obligations.

- Bankruptcy: Initiated by court order under UAE Commercial Transactions Law if the company cannot meet its debt obligations.

The company termination application will result in the cancellation of directors’ responsibilities, and the authority will publish a public announcement of the closure in a local newspaper. Once all requirements are met, the free zone authority finalizes the termination and issues an official termination letter.

Step 2: Specific procedures for different Free Zones

Each free zone authority has distinct guidelines:

- DMCC: Requires a newspaper announcement, a grace period for debt claims, and strict review of all submitted documentation before issuing the termination letter.

- JAFZA: Requires advance notice, with specific timelines for different facilities (e.g., three months for office/warehouse closures and six months for plots).

Additional requirements might involve security checks, especially if the company has been linked to regulated industries. To proceed smoothly, companies must adhere to each free zone’s specific protocols, often coordinated through member portals or approved service channels.

Step 3: Documentation requirements

Proper documentation is essential to complete the closure. Required documents include:

- Board Resolution: A notarized resolution from the company’s shareholders approving the closure and liquidation.

- Liquidation Report: Some free zones require a liquidation report to confirm the company’s financial position.

- Lease Termination: Proof of lease cancellation for rented facilities in the free zone.

- Clearance Certificates: NOCs from utility providers (e.g., DEWA, Etisalat) and other relevant agencies to confirm all dues are paid.

These documents must be submitted along with the application for license cancellation through the respective free zone authority. In cases where further verification is needed, a liquidator may be appointed to oversee the process.

Step 4: Settling financial obligations

While the steps for settling financial obligations in free zones resemble those on the mainland, they include additional zone-specific requirements. All debts, outstanding payments, and financial liabilities must be cleared. The company should also obtain clearance from customs (if relevant) and cancel any corporate bank accounts. Most free zones, including DMCC, require a "No Liability" letter from the registrar confirming the company’s debts have been resolved.

It’s critical to follow these procedures meticulously, as outstanding debts or unresolved financial issues can affect shareholders’ future business activities in the UAE and potentially their credit standing.

Step 5: Employee termination procedures

Companies are generally required to give employees a two-month paid notice period before termination. Visa cancellations are then handled through the GDRFA and must be coordinated with free zones that liaise with federal labor authorities.

It’s also necessary to clear any remaining employee dues, including end-of-service gratuities and other entitlements. Properly settling all employee rights is essential to avoid potential disputes or legal issues.

Step 6: Utility and service cancellation

The final step involves canceling all utility and telecommunications services. NOCs are required from providers like DEWA (Dubai Electricity and Water Authority) and Etisalat or du (telecom services) to confirm that all accounts have been settled. Companies must also notify any other service providers or landlords and ensure all service-related obligations are cleared.

After all these requirements are fulfilled, the company can submit the final application to the free zone authority. Upon review and approval, the free zone authority will issue a formal termination letter, officially closing the business.

Post-closure considerations

After officially closing a business in the UAE, there are essential steps to consider preventing future complications and to ensure all legal obligations are fulfilled. Here’s what to keep in mind:

Maintaining records for potential audits or disputes

Upon closure, business owners should securely archive all financial and legal documents related to the company’s operations and closure process. This includes:

- Retain comprehensive records of financial statements, final audits, and tax filings. These may be requested if the business undergoes a post-closure audit or review by regulatory authorities.

- Retain copies of all documents related to the liquidation process, including the board resolution for liquidation, termination letters, and any NOCs from utilities or service providers.

- Safeguard records pertaining to employee terminations, final settlements, and canceled visas, as they may be necessary to address any future employee claims or audits by the Ministry of Human Resources and Emiratisation (MOHRE).

In the UAE, the statutory period for maintaining business records is typically five years, but holding onto these records longer is often advisable for future clarity and legal protection.

Understanding the implications of business closure on personal liability and future business opportunities

Closing a business may have repercussions on an owner’s financial and legal standing in the UAE, impacting their ability to pursue future opportunities. Some considerations include:

- Depending on the business structure (such as an LLC or sole proprietorship), company owners or directors may retain some personal liabilities post-closure. Ensuring that all outstanding debts, taxes, and fees have been settled with banks, vendors, and government authorities is crucial to prevent future claims.

- Unresolved financial obligations could affect personal credit scores in the UAE, potentially impacting future access to credit or investment opportunities. Closing all corporate bank accounts in good standing and obtaining “No Liability” letters can mitigate these risks.

- Successfully closing a business according to UAE regulations helps establish a positive reputation with authorities. This can facilitate approvals or permits for future ventures, as regulatory bodies may review past records when evaluating new applications.

Lastly, former business owners may want to seek legal counsel to understand any ongoing obligations post-closure, such as periodic updates to authorities or notifications if any dormant assets or liabilities come to light.