What is corporate tax?

Corporate Income Tax (CIT) is a direct tax levied on the net income or profits generated by corporations and other business entities.

The CIT framework in the UAE is governed primarily by Federal Decree-Law No. (47) of 2022, with subsequent amendments introduced in Federal Decree-Law No. (60) of 2023. Together, these laws set out the detailed requirements for CIT, including its scope, rates, and exemptions. Under these provisions, corporate tax applies to businesses with annual profits above AED 375,000, with taxable profits below this threshold remaining exempt. Additionally, a 9 percent CIT rate applies to eligible profits above AED 375,000, with a specialized, yet-to-be-determined rate for certain large multinational entities that meet criteria related to the OECD’s Pillar Two global minimum tax rule.

The Federal Tax Authority (FTA) is tasked with administering and enforcing CIT, ensuring compliance across all Emirates. The FTA provides businesses with guidelines on registration, tax filing, and payment procedures, further supporting businesses in navigating the new tax requirements.

Effective dates and transitional provisions

The CIT law took effect on June 1, 2023, with its initial application determined by each business’s specific financial year. For example, companies whose fiscal year begins on June 1, 2023, will fall under the CIT regime as of that date, with their first tax filings expected toward the end of 2024. Similarly, companies following a calendar year beginning January 1, 2024, will see their CIT obligations start from that date, with filings likely due by mid-2025.

Corporate tax rates and scope in the UAE

Tax rates

The UAE’s Corporate Income Tax (CIT) system, enacted as of June 1, 2023, implements a progressive tax structure designed to balance growth incentives for small businesses with sustainable revenue generation from larger corporations. Under this framework:

|

Category |

Description |

CIT Rate or condition |

Additional notes |

|

Small Businesses and Startups |

Taxable income not exceeding AED 375,000 |

0% |

Supports entrepreneurs and small businesses by exempting them from CIT. |

|

Larger Businesses |

Taxable profits exceeding AED 375,000 |

9% |

Competitively low CIT rate within the global tax landscape, promoting business growth and alignment with international norms. |

|

Multinational Enterprises (MNEs) |

MNEs with consolidated global revenues over AED 3.15 billion |

15% (Top-Up Tax) |

Applies as part of the OECD BEPS Pillar Two framework, aimed at preventing profit shifting and ensuring fair tax contributions across jurisdictions. |

|

Withholding Tax (WHT) |

Specific categories of UAE-sourced income for non-residents without a permanent establishment (PE) in the UAE |

0% |

Applies to non-resident income, set at 0% currently; subject to change if specified in a future Cabinet decision. |

|

Resident Taxable Persons |

UAE-resident individuals and entities, subject to UAE corporate tax on worldwide income |

Taxed on worldwide taxable income |

Encompasses all global income of UAE residents, reflecting the UAE’s position as a global business hub. |

|

Non-Resident Taxable Persons |

Non-residents with taxable income linked to a UAE PE or “nexus” |

Taxed only on UAE-sourced taxable income linked to a UAE nexus or PE |

Ensures non-residents are taxed only on UAE-based income, with additional WHT on specific categories of UAE-sourced income not tied to a PE. |

Who are the subjects of Corporate Tax in the UAE?

The UAE’s Corporate Tax (CIT) law, introduced in June 2023, outlines specific categories of “Taxable Persons” required to pay CIT based on their residency status, business activities, and connection to the UAE market. Here’s a breakdown of who falls under the UAE’s CIT obligations.

Resident Persons

Resident Persons are subject to CIT on their global income, which includes both UAE-sourced and foreign-sourced revenue. This category encompasses:

- UAE Incorporated Entities: Companies and other juridical entities incorporated in the UAE are automatically classified as Resident Persons. This includes businesses formed under mainland regulations, free zone authorities, or by special legislative decree.

- Foreign Entities with Effective Management in the UAE: Foreign entities with primary management activities within the UAE—meaning strategic and commercial decisions are largely made within the country—are also considered resident taxpayers and liable for CIT on their worldwide income.

- Natural Persons Conducting Business: Individuals engaged in business activities that generate income within the UAE are also subject to CIT as Resident Persons. However, this only applies to income derived from business activities specifically defined in a Cabinet Decision, excluding personal income from employment or personal investments.

Non-Resident Persons

Non-Resident Persons are foreign juridical entities not incorporated or managed within the UAE but may still have CIT obligations based on certain criteria. Non-residents are taxed only on income sourced from within the UAE. This includes:

- Permanent Establishments (PE): Foreign businesses that establish a Permanent Establishment (PE) in the UAE, such as through a branch, office, or other fixed site, are liable for CIT on UAE-sourced income directly tied to the PE. A PE represents a level of ongoing commercial presence sufficient to trigger taxation in the UAE.

- UAE-Sourced Income: Non-residents who do not have a PE but earn income within the UAE, such as from investments in real estate or royalties, are subject to CIT on this UAE-sourced income. Non-PE UAE-sourced income is generally subject to a withholding tax (WHT) of 0 percent, but certain types of income may incur a tax rate based on future Cabinet decisions.

Corporate tax on free zone entities

Entities established in Free Zones may qualify as Qualifying Free Zone Persons (QFZPs) under specific conditions, including:

- Deriving qualifying income from activities specified in the CT Law.

- Maintaining adequate substance in the UAE.

- Complying with transfer pricing (TP) rules and documentation requirements.

- Preparing audited financial statements.

QFZPs benefit from a 0 percent CT rate during the tax incentive period, provided they comply with the relevant conditions.

Multinational Enterprises (MNEs)

A special consideration applies to large multinational enterprises (MNEs) with global consolidated revenues exceeding AED 3.15 billion, which fall under the OECD’s Base Erosion and Profit Shifting (BEPS) framework’s “Pillar Two” regulations. These MNEs may be subject to an additional “top-up tax,” resulting in a minimum effective tax rate of 15 percent on their UAE income to align with international tax standards on large multinationals.

What constitutes a Permanent Establishment?

The UAE determines whether foreign companies need to pay tax largely based on whether they have a "permanent establishment" (PE) in the country. This concept follows international standards set by the OECD.

There are two main ways a PE can be created:

- Fixed Place PE: This happens when a foreign business has a fixed physical location in the UAE. For example:

- A branch office usually counts as a PE

- A representative office usually does not count, especially if it only does basic support activities

- Agency PE: This occurs when a company has someone in the UAE who regularly makes deals on their behalf. This person must be dependent on the foreign company (not working independently) and able to negotiate or conclude contracts.

Tax implications:

- Foreign companies with a PE must register for UAE Corporate Tax

- If their PE is in a Free Zone and meets certain conditions, they might qualify for a 0 percent tax rate

- Otherwise, they pay normal UAE tax rates on income from the PE

- The first AED 375,000 is taxed at 0 percent

- However, PEs could not claim small business tax relief

Which subjects are exempt and which deductions are allowed under UAE Corporate Tax?

The UAE Corporate Tax (CIT) regime offers specific exemptions and deductions aimed at promoting investment, reducing tax burdens for essential sectors, and aligning with international standards to avoid double taxation. Below, we’ll cover key exemptions and permissible deductions, emphasizing how they benefit different types of taxpayers in the UAE.

Exempt entities

|

Exempt Entities |

Description |

Exempt/Exclusion Type |

Additional Notes |

|

Government Entities |

Federal and emirate-level government bodies, along with their departments and authorities |

Automatically Exempt |

Aimed at supporting public services and economic stability. |

|

Government-Controlled Entities |

Entities controlled by the government specified in Cabinet Decisions |

Automatically Exempt |

Applies to entities contributing to public welfare and specified in UAE Cabinet Decisions. |

|

Extractive Businesses |

Businesses involved in natural resource extraction (e.g., oil, gas) |

Exempt (with Notification to Ministry of Finance) |

Must also be subject to emirate-level taxation, reflecting the UAE's economic strategy. |

|

Non-Extractive Natural Resource Businesses |

Businesses associated with extractive industries (e.g., processing of natural resources) |

Exempt (with Notification to Ministry of Finance) |

|

|

Qualifying Public Benefit Entities |

Non-profit organizations engaging in public welfare, charitable, or social activities |

Exempt (with Cabinet Decision) |

Requires listing in a Cabinet Decision and alignment with public welfare missions. |

|

Pension and Social Security Funds |

Public or private funds for pensions and social security |

Exempt (upon approval by Federal Tax Authority) |

Supports long-term savings for citizens and residents. |

|

Qualifying Investment Funds |

Funds that meet specific criteria to qualify for exemption |

Exempt (upon approval by Federal Tax Authority) |

Includes funds focused on capital preservation and growth for residents and institutions. |

|

Wholly Owned Subsidiaries of Exempt Entities |

Subsidiaries of already exempt entities (e.g., government entities, investment funds) |

Exempt if wholly owned by exempt entities |

Simplifies tax treatment for entities under full control of exempt bodies, provided they meet criteria. |

Exempt income

|

Exempt Income |

Description |

Exempt/Exclusion Type |

Additional Notes |

|

Dividends and Profits Distributions |

Dividends from UAE-based or foreign entities in which the UAE entity has a “Participation Interest” |

Exempt |

Exemption prevents double taxation on earnings already taxed abroad or by other entities. |

|

Capital Gains |

Gains from the sale of shares or securities in entities where a “Participation Interest” is held |

Exempt |

Applies provided “Participation Exemption” conditions are met, promoting investments in securities. |

|

Foreign Permanent Establishment Income |

Income from foreign branches or establishments if the taxpayer elect’s exclusion |

Exempt (Elective) |

Provides flexibility to UAE-based businesses with operations abroad, ensuring no double taxation. |

|

Non-Resident Shipping and Aviation Income |

Income derived by non-residents from international shipping or aviation activities |

Exempt (subject to conditions) |

Encourages international transportation services in the UAE. |

Deductible expenses

|

Deductible Expenses |

Description |

Exempt/Exclusion Type |

Additional Notes |

|

General Business Expenses |

Costs “wholly and exclusively” incurred for business purposes |

Deductible |

Includes salaries, rent, utilities, and other operational expenses linked to taxable income. |

|

Depreciation of Capital Assets |

Costs for purchasing capital assets such as property or equipment |

Deductible (Depreciation or Amortization) |

Recognized over the economic life of the asset, aligning deductions with asset utilization. |

|

Client Entertainment Expenditure |

Costs for entertaining clients |

Partially Deductible (50%) |

Balanced to prevent excessive entertainment spending. |

|

Interest Expenditure |

Interest costs on financing for business activities |

Deductible (up to 30% of EBITDA) |

Limits deductions to prevent over-leveraging, with cap based on earnings before interest, taxes, depreciation, and amortization (EBITDA). |

|

Bribes |

Payments that are unlawful or unethical |

Non-Deductible |

|

|

Fines and Penalties |

Penalties for legal breaches (except for compensatory damages) |

Non-Deductible |

Discourages unlawful conduct by disallowing tax benefits on such payments. |

|

Donations, Grants, or Gifts |

Payments to entities not considered Qualifying Public Benefit Entities |

Non-Deductible |

Only donations to qualified entities can be deducted to encourage contributions to recognized charities. |

|

Corporate Tax Itself |

Tax paid under UAE Corporate Tax Law |

Non-Deductible |

Reflects standard practice where corporate taxes cannot be deducted from taxable income. |

|

Expenditures Not for Business |

Expenses not solely for deriving taxable income |

Non-Deductible |

Ensures tax deductions align strictly with genuine business activities. |

|

Expenditures Related to Exempt Income |

Costs associated with generating exempt income (e.g., expenses tied to tax-exempt dividends) |

Non-Deductible |

Ensures consistency by disallowing deductions on income already excluded from taxation. |

Foreign tax credits

To avoid double taxation, companies paying foreign taxes on overseas income may claim a foreign tax credit (FTC) against their UAE CIT liability. However, the FTC cannot exceed the UAE tax due on the relevant foreign income and is forfeited if unused, aligning UAE tax policy with international practices.

The UAE Corporate Tax framework strategically exempts and deducts certain incomes and expenses to balance tax efficiency, social impact, and economic growth. By focusing on essential exemptions and responsible deductions, the UAE provides a competitive tax regime designed to support both domestic growth and international expansion for businesses operating within its borders.

Filing and compliance requirements

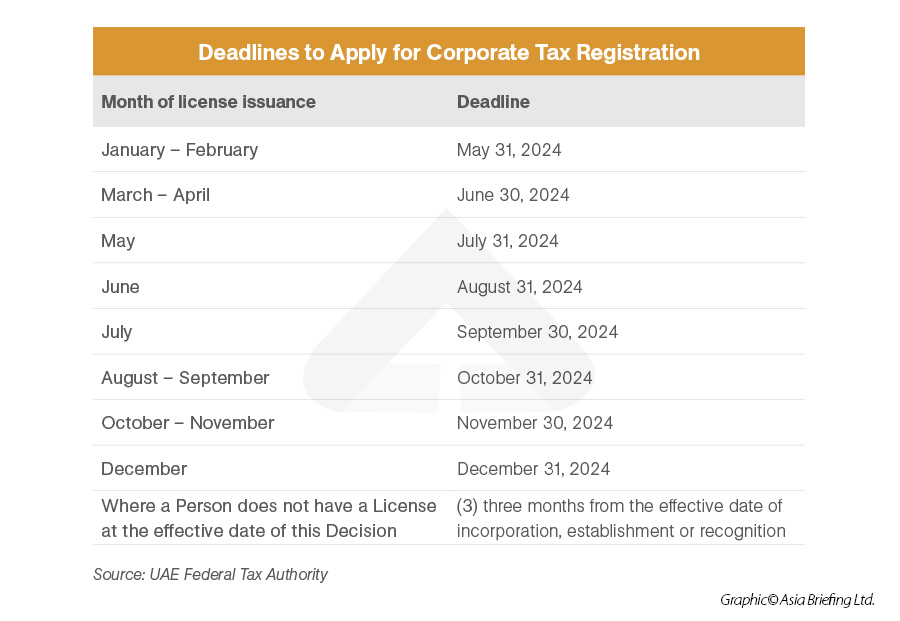

The deadline for applying for CT registration depends on the month in which the taxpayer was issued their business license. Note that the year in which the license was issued does not affect the registration deadline.

In addition to the above deadlines, the FTA’s Decision on timeframes for CT registration sets a range of other registration deadlines depending on the entity’s circumstances:

- Entities that do not have a license by the time the Decision took effect March 1, 2024, must apply to register within three months of this date, that is, May 31, 2024.

- Entities that hold multiple licenses must adhere to the registration deadline that corresponds to the date of their last issued license.

- Resident entities, including Free Zone Persons, and businesses that are incorporated, established, or otherwise recognized under UAE law on or after March 1, 2024, must apply within three months from the date of incorporation, establishment, or recognition.

- Resident entities that are incorporated, established, or otherwise recognized under the laws of another country or foreign jurisdiction, but are effectively managed and controlled in the UAE on or after March 1, 2024, must apply within three months from the end of their financial year.

- Non-resident entities with a permanent establishment in the UAE before March 1, 2024, must apply within nine months from the date of the existence of the permanent establishment, while non-resident entities with a nexus in the country must apply to register by May 31, 2024.

- Entities that are non-resident on or after March 1, 2024, and have a permanent establishment must apply within six months of the existence of the permanent establishment, while entities that are non-resident with a nexus in the UAE on or after March 1, 2024, must apply within three months from the date of establishing the nexus.

- Resident individuals who engage in business or conduct business activities during the 2024 calendar year, and who have exceeded the turnover threshold (AED 375,000), must apply by March 31, 2025.

- Non-resident individuals who engage in business or conduct business activity during the 2024 calendar year 2024 and subsequent years, and whose turnover has exceeded the specified threshold, must apply within three months from the date of fulfilling the conditions to be considered a taxable person.

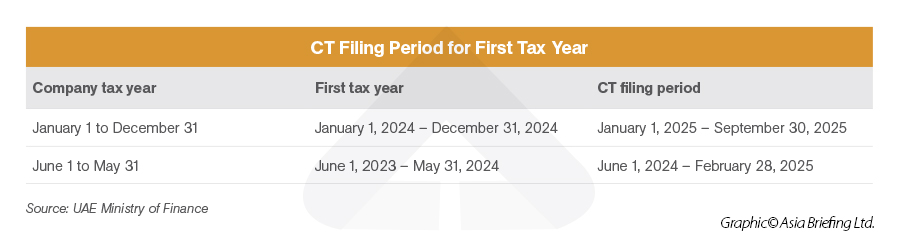

Taxpayers are required to file CT returns for each tax period within nine months of the end of each tax period. Any CT that taxpayers are liable for must generally also be paid within this timeframe.

The specific deadline for filing and paying CT, as well as the start of the first tax year since the CTL took effect, depends on the company’s financial year, as shown in the table below.

Non-compliance and penalty

Entities that fail to apply for CT registration within the specified deadline will result in a penalty of AED 10,000 (US$2,722), which aligns with penalties imposed for the late registration of excise tax and value-added tax.

Meanwhile, failure to file the CT returns within the specified timeframes will incur a fine of AED 500 (US$136) for each overdue month (or part thereof) for the first 12 months, and AED 1,000 (US$272) for each month from the 13th month onward (or part thereof).

Taxable persons are required to maintain financial statements in accordance with International Financial Reporting Standards (IFRS) and keep supporting documentation for a period of seven years. In addition to the record-keeping, taxable persons with revenues exceeding AED 50 million must prepare audited financial statements.