Establishing a business in the United Arab Emirates (UAE) is a gateway to one of the most dynamic and investor-friendly markets in the world. The UAE’s strategic location, robust infrastructure, and business-friendly policies make it an ideal destination for startups, small enterprises, and multinational corporations alike.

The UAE offers a wide range of business structures and strategies to suit diverse investor needs. Whether you are looking to establish a mainland company, leverage free zone benefits, or explore alternative entry strategies, the UAE provides an ecosystem conducive to growth and success. By understanding the regulatory landscape and choosing the right approach, businesses can unlock significant opportunities in this dynamic market.

This article explores the key aspects of setting up a business in the UAE and offers insights into the various structures, regulations, and processes available to investors.

Business types and structures for investors

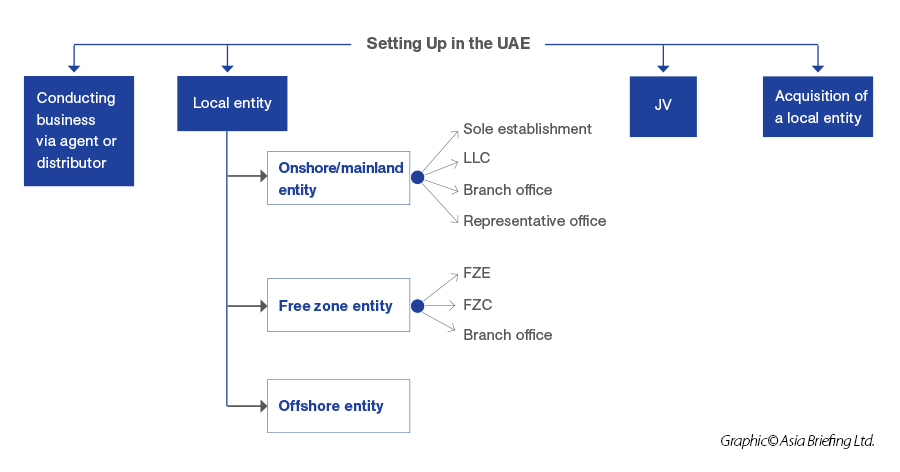

The UAE offers three main business structures, each catering to specific investor needs.

- Mainland companies provide unrestricted access to the local market, making them ideal for businesses targeting domestic consumers or government contracts.

- Free zone entities are designed to offer tax benefits and industry-specific infrastructure, perfect for companies in logistics, technology, and manufacturing.

- Offshore companies, meanwhile, are suited for holding investments or managing global assets, offering cost-effective solutions for businesses without operational needs in the UAE.

Each structure has its unique advantages. Mainland companies enjoy flexibility in operations and office location but may require local ownership in some strategic industries. Free zones, by contrast, allow 100% foreign ownership, corporate tax exemptions, and access to high-quality facilities, though they restrict direct trade with the UAE mainland. Offshore companies benefit from no corporate tax and minimal setup requirements but cannot operate within the UAE.

How to set up a company in UAE Free Trade Zones

The UAE’s free trade zones are designed to attract foreign investors by offering streamlined processes and industry-specific advantages. Businesses can benefit from 100% foreign ownership, zero corporate taxes, and complete profit repatriation.

Notable free zones include Jebel Ali Free Zone (JAFZA) for logistics, Dubai Internet City for tech, and Abu Dhabi Global Market (ADGM) for finance.

Setting up a free zone company involves selecting the appropriate zone, registering with the relevant authority, and obtaining the necessary trade licenses. Many zones also offer flexi-desk solutions for startups or smaller enterprises, simplifying the operational setup.

Set up a Mainland business in UAE

Mainland companies are governed by the UAE Commercial Companies Law (CCL) and provide full access to the UAE’s domestic markets. With recent reforms, foreign investors can now own 100% of mainland companies in most sectors. Mainland entities, such as Limited Liability Companies (LLCs), also enjoy fewer operational restrictions compared to free zones.

The process includes securing a trade license, registering with the Department of Economic Development (DED), and leasing office space. Mainland setups are ideal for businesses looking to expand their local footprint or work directly with government contracts.

Comparison of business types in the UAE

Choosing the right business type in the UAE depends on your operational needs, target markets, and long-term goals. Each structure has its own benefits and limitations, and careful consideration is essential to maximize the potential of your UAE business.

|

Entity Type |

Key Benefits |

Limitations |

|

Mainland Companies |

Full access to UAE markets; ability to bid for government contracts; 100% foreign ownership in most sectors. |

Some sectors require local ownership (e.g., strategic industries); additional compliance requirements for local laws. |

|

Free Zone Entities |

100% foreign ownership; tax exemptions; streamlined processes; access to sector-specific infrastructure. |

Restricted from conducting business directly in the UAE mainland without appointing a local distributor or setting up a branch. |

|

Offshore Companies |

No residency or office requirements; cost-effective for asset management; zero corporate tax. |

Cannot conduct business within the UAE; limited banking options; restrictions on operational activities locally. |

|

Joint Ventures (JVs) |

Combine local market knowledge with foreign expertise; access to local networks and resources. |

Requires careful agreement structuring; shared management may create complexities in decision-making. |

|

Agents/Distributors |

Low-cost market entry; no need for a physical presence; access to local market connections through experienced distributors. |

Limited control over operations; Commercial Agencies Law provides strong protections for local agents. |

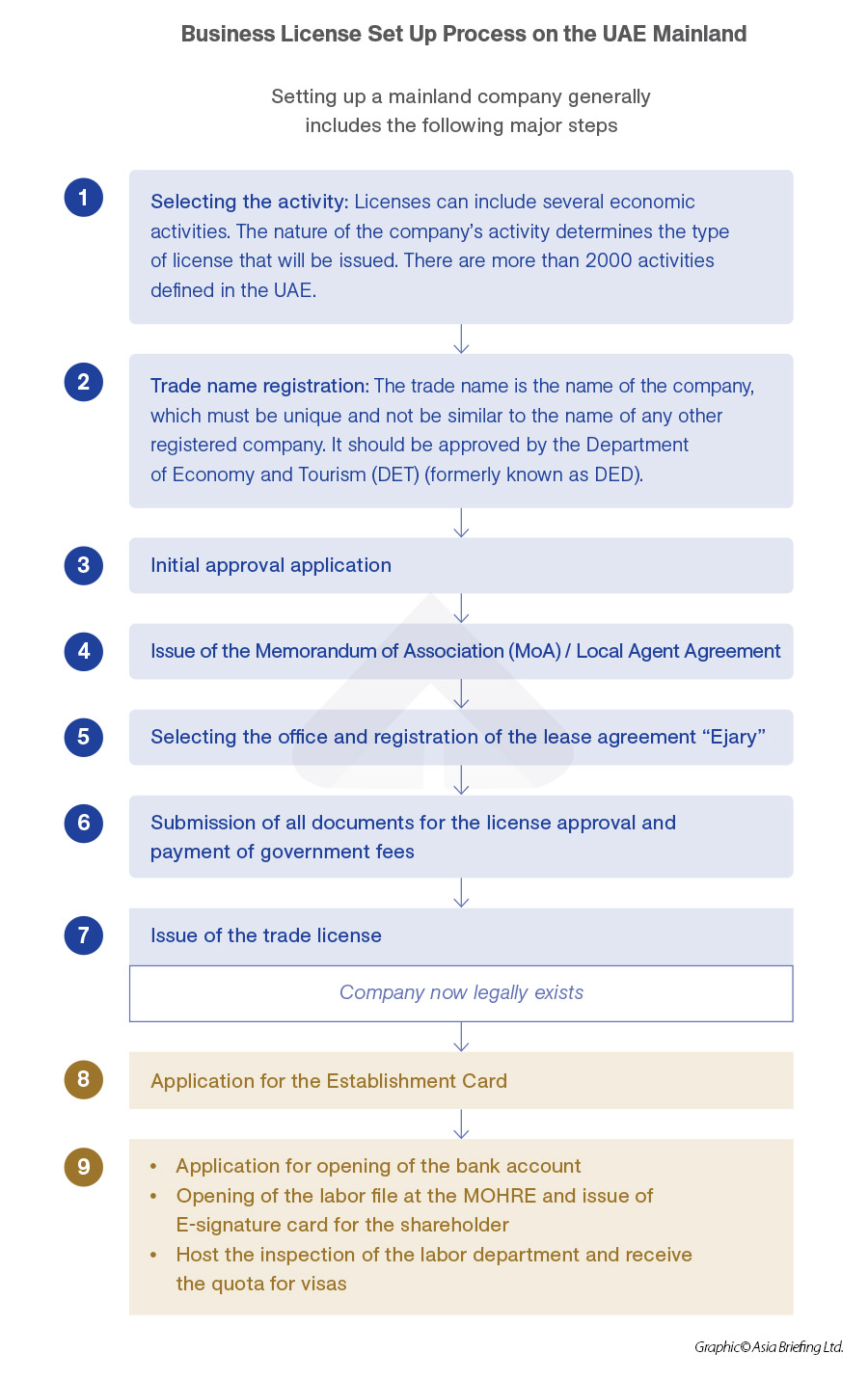

Step-by-step guide to company registration

While the process of registering a company in the UAE is well-defined, the steps can vary depending on the chosen jurisdiction. Typically, businesses must first determine their activity type and the corresponding license. After reserving a trade name, initial approvals are obtained, and key documents such as the Memorandum of Association (MOA) are prepared. For mainland companies, registering the lease agreement (Ijary) is mandatory.

Once all documentation is submitted and government fees are paid, a trade license is issued. Businesses then proceed to open a corporate bank account and set up labor files with the Ministry of Human Resources and Emiratisation (MOHRE). Free zones often streamline these steps, providing single-window solutions for setup and administration.

Frequently asked question: Key considerations for setting up a business in UAE

How can businesses enter the UAE market?

Mainland companies are governed by the UAE Commercial Companies Law (CCL) and provide full access to the UAE’s domestic markets. With recent reforms, foreign investors can now own 100 percent of mainland companies in most sectors. Mainland entities, such as Limited Liability Companies (LLCs), also enjoy fewer operational restrictions compared to free zones.

The process includes securing a trade license, registering with the Department of Economic Development (DED), and leasing office space. Mainland setups are ideal for businesses looking to expand their local footprint or work directly with government contracts.

How to do business without setting up an entity in the UAE?

Businesses that do not wish to establish a physical presence in the UAE can operate through alternative arrangements, such as appointing agents or distributors. This model is particularly useful for foreign companies testing the UAE market or operating on a limited scale.

The UAE’s Commercial Agencies Law governs such arrangements, providing significant protections to local agents. Foreign companies should seek legal advice to structure these agreements effectively.

How to manage Intellectual Property in the UAE?

Protecting intellectual property (IP) is a top priority for businesses in the UAE, especially in innovation-driven industries. The UAE provides a robust legal framework to safeguard trademarks, patents, copyrights, and industrial designs. Companies are encouraged to register their IP rights with the relevant UAE authorities to ensure protection.

The country’s adherence to international agreements, such as the World Intellectual Property Organization (WIPO), further reinforces its commitment to IP protection, making it a secure environment for creative and innovative enterprises.

How to open a bank account for businesses in the UAE?

Opening a corporate bank account is a crucial step for businesses operating in the UAE. Banks in the UAE offer services tailored to the needs of startups, SMEs, and multinational corporations, ensuring smooth financial operations. The process involves submitting the company’s trade license, Memorandum of Association (MOA), and other legal documents.

Choosing the right bank depends on your business requirements, such as transaction volumes and international trade needs. Ensuring compliance with UAE regulations, such as anti-money laundering (AML) policies, is essential during the application process.

What should I consider when choosing a location in the UAE?

When choosing a location in the UAE, consider whether you need access to the local market (mainland), tax benefits and sector-specific infrastructure (free zones), or a cost-effective structure for holding assets (offshore). Your decision should align with your target audience, operational needs, and industry requirements.

How difficult is it to close a business in the UAE?

The process of closing a business in the UAE involves several administrative steps, including canceling trade licenses, settling liabilities, and deregistering with relevant authorities. Businesses must also ensure compliance with labor laws, such as employee end-of-service benefits and visa cancellations.

Thorough planning and coordination with local authorities are essential to avoid penalties and ensure a smooth transition.