UAE Retains Crown as World’s Top Wealth Magnet: A Closer Look

For the third consecutive year, the UAE holds the position of the world’s top “wealth magnet,” a testament to its appeal for high-net-worth individuals.

By Qian Zhou

The United Arab Emirates (UAE) has retained its position as the world’s top “wealth magnet” for the third consecutive year. Its favorable tax regime, golden visa policy, luxury lifestyle, and strategic location continue to attract high-net-worth individuals (HNWIs).

In 2024, the UAE is projected to welcome a record-breaking 6,700 millionaires—nearly twice as many as its closest competitor, the US, which anticipates a net inflow of 3,800 millionaires.

In this article, we’ll take a closer look at the origins of these wealthy migrants, the reasons behind the UAE’s appeal, and the implications.

The UAE as the world’s leading wealth magnet: The latest survey

On July 18, 2024, the Henley Private Wealth Migration Report 2024 was released by international investment migration advisory firm Henley & Partners, which features the latest net inflows and outflows of millionaires from specific countries. The millionaires in the report refer to HNWIs with liquid investable wealth of US$1 million or more.

|

Net Inflow of Millionaires into the UAE 2022-2024 |

||

| Year | No. of net inflow millionaires | World ranking |

| 2024* | 6,700 | Top 1 |

| 2023* | 4,500 | Top 1 |

| 2022 | 5,200 | Top 1 |

| *Estimates Source: Henley Private Wealth Migration Report 2024 |

||

The UAE consistently attracts large numbers of millionaires from India, the Middle East and Africa (MEA), and Russia. In 2024, large inflows are also expected to come from the UK and Europe, which shows the Gulf destination’s growing appeal.

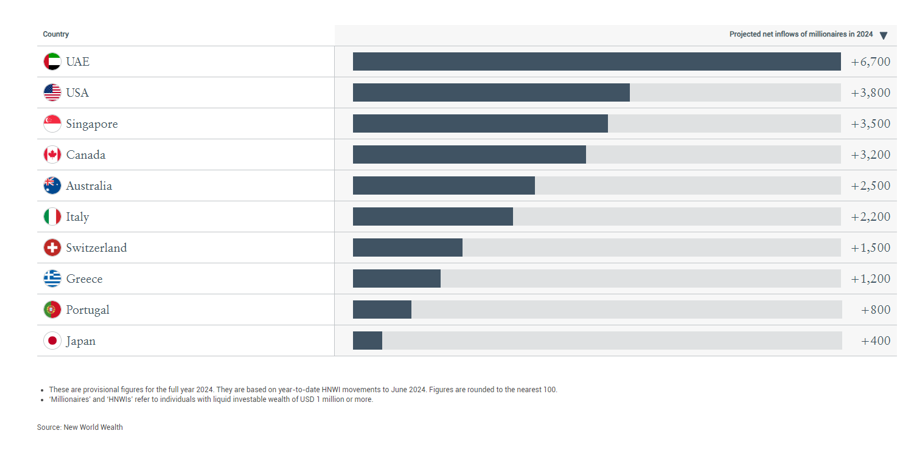

Other countries with the most net millionaire inflows include the US, Singapore, Canada, Australia, Italy, Switzerland, Greece, Portugal, and Japan as seen below:

Reasons behind the UAE’s continued appeal

The UAE’s allure for affluent HNWIs primarily stems from its attractive income tax regime, golden visa programs, luxury lifestyle, and strategic location.

In particular, Sunita Singh-Dalal, Partner at Private Wealth & Family Offices at Hourani in Dubai points out that “the evolution and development of the UAE’s wealth management ecosystem is unprecedented. In less than 5 years, the UAE has introduced a robust regulatory framework that provides the wealthy with a range of innovative solutions to protect, preserve and enhance their wealth.”

Preferential tax policies

The UAE is a low-tax country, whose tax policies are preferential to the HNWI group:

- The UAE has no individual income tax.

However, for natural persons engaged in business activities within the UAE, if their income exceeds a certain threshold, they are subject to corporate tax. - The UAE only started to impose corporate income tax (CIT) very recently – from June 30, 2023 – and its CIT rates are very competitive compared to other economies.

The UAE’s CIT is based on accounting profits, with the tax rate divided into three brackets – a 0 percent tax rate that applies to annual taxable income below 375,000 dirhams (approximately US$100,000); a 9 percent tax rate that applies to amounts above 375,000 dirhams; and a separate tax rate that applies to large multinational companies with global business revenues exceeding 750 million euros (approximately US$850 million). The latter is aligned with the BEPS 2.0 Pillar 2 – global minimum taxation. - The UAE offers various exemptions: enterprises in free zones continue to benefit from tax exemption policies. Additionally, income from real estate investments, dividends, earnings from holding stocks or bonds, interest on deposits, foreign investors’ dividends, capital gains, interest income, royalties, and other investment income are all exempt from taxation.

- The UAE imposes a 5 percent value added tax (VAT) on taxpayers who provide taxable goods and services domestically or import taxable goods and services.

However, the VAT rate is zero for exported goods and services, education, healthcare, oil and natural gas, international passenger and cargo transport, qualified transportation vehicles and related services, newly built or renovated residences, buildings used by charitable organizations, and investment in precious metals. Qualified financial services, local passenger transport, residential construction, and bare land supply are exempt from VAT. Additionally, VAT is also exempted for wholesale diamond jewelry and gold, platinum, and silver ornaments.

Golden visa program

The UAE has introduced the “Golden Residency” program, an forward looking initiative that offers long-term residency to a broad spectrum of individuals without the need for an in-country sponsor. This program grants a 10-year residence permit and is designed to attract talented individuals, researchers, outstanding students, doctors, specialists, innovators, athletes, entrepreneurs, investors, and emerging companies. Not only does this program benefit these individuals, but it also extends to their family members, creating a supportive and inclusive environment for expatriates.

For wealthy millionaires, they may apply for the golden visa issued to entrepreneurs, real estate investors, and public investment investors by meeting corresponding criteria. More information can be found in our article: UAE Golden Visa Program: A Gateway to Long-Term Residency

Wealth management eco-system

The UAE’s newly launched “Family Wealth Centre” serves as a guide for wealthy individuals and businesses to overcome challenges ranging from digitalization, cultural issues, governance, and succession planning.

Further, the UAE’s new “Family Arrangements Regulations” is designed to preserve and grow family businesses as well as family wealth in the country, which is very attractive for HNWIs.

Strategic location and other factors

The UAE benefits from its strategic location bridging Europe and the MEA, making it an ideal hub for internation business and travel.

Besides, known for its opulent lifestyle, the UAE offers a high standard of living with luxury real estate, shopping, dining, and entertainment options as well as healthcare and education facilities for expat families.

Overall, the UAE’s modern infrastructure, its politically stable and neutral environment, and an increasingly diversified economy contribute to the UAE’s reputation as a world-leading destination for wealthy migrants.

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE). Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China (including the Hong Kong SAR), Indonesia, Singapore, Malaysia, Mongolia, Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Middle East Briefing’s content products, please click here. For support with establishing a business in the Middle East or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com.