Saudi Arabia Extends Expat Fee Waiver for the Industrial Sector to Boost Growth

Saudi Arabia has extended its expatriate fee waiver for industrial sector workers until December 31, 2025, building on the policy introduced in 2019. This extension aims to stimulate further growth and attract investment in the sector and provide a favorable environment for business owners and investors interested in the region.

By Estelle Xiao

Understanding the expat fee waiver

The expatriate fee waiver is a strategic decision by the Saudi government to exempt employers in the industrial sector from paying fees associated with hiring foreign workers. This policy is advantageous to expatriates, who are professionals or skilled workers who accept positions outside of their home countries. It makes it more cost-effective for companies to employ them.

The original initiative, approved in September 2019, covered financial compensation for expat workers in industrial establishments for five years, starting from October 1, 2019. The aim was to enhance the competitiveness of Saudi Arabia’s national industry on a global scale, provide more job opportunities, and boost the country’s non-oil exports.

The expatriate fee waiver has been a cornerstone of Saudi Arabia’s industrial sector expansion, enabling businesses to allocate resources more efficiently. By removing the financial burden of expatriate fees, companies have been able to reinvest these funds into enhancing production capabilities, adopting advanced technologies, and expanding their workforce. The subsequent 12 percent growth in non-oil exports is a clear indication of how this policy has bolstered the sector’s global competitiveness.

Industrial sector performance and economic growth

Since the implementation of the expat fee waiver, Saudi Arabia’s industrial sector has experienced remarkable growth. From 2019 to April 2024, the number of industrial facilities increased from 8,822 to 11,868, representing significant expansion. Employment in the sector grew by 57 percent, and the localization rate—a measure of the proportion of local workers in the sector—rose to 32 percent. Investment in the industrial sector also saw a substantial rise, with the total value increasing by 55 percent, from approximately US$264 billion in 2019 to over US$410 billion by the end of 2023. Non-oil exports grew by 12 percent, and more than 8,000 industrial establishments benefited from the expat fee exemption during this period.

Saudi Arabia’s economic transformation is progressing well, underpinned by successful fiscal reforms and improvements in the regulatory business environment, which have bolstered non-oil growth. The National Industrial Strategy, which aims to reduce the country’s reliance on hydrocarbons, is central to this transformation. It includes targeted interventions such as the establishment of Special Economic Zones (SEZs).

Outlook of Saudi Arabia’s industrial sector

The extension of the expat fee waiver is part of Saudi Arabia’s broader strategy to reform its economy, reduce dependence on oil, diversify income sources, and enhance competitiveness. This initiative aligns with the kingdom’s ambitious Vision 2030 plan, which aims to transform the Saudi economy through significant structural reforms.

As the country continues to diversify its economy and attract foreign investment, foreign investors can take advantage of the favorable regulatory environment, robust domestic demand, and the kingdom’s strategic position as a gateway to the broader Middle East region.

Economic diversification

Non-oil growth has accelerated in recent years, averaging 4.8 percent in 2022, with projections to remain close to 5 percent in 2023. This growth is driven by strong domestic demand and improvements in the regulatory and business environment. The extension of the expatriate fee waiver is instrumental in maintaining this momentum, as it alleviates cost pressures on businesses, allowing them to reinvest in the non-oil sectors. Projections indicate that non-oil growth will continue at around 3.5 percent in 2024, further highlighting the importance of supportive policies like the fee waiver in sustaining economic stability and growth.

Reforms to boost investment

Saudi Arabia has introduced new laws to promote entrepreneurship, protect investors’ rights, and reduce the costs of doing business, leading to a 95 percent increase in new investment deals and a 267 percent rise in new licenses in 2022. The Public Investment Fund (PIF) has also played a crucial role in stimulating private sector investment.

Major industrial hubs

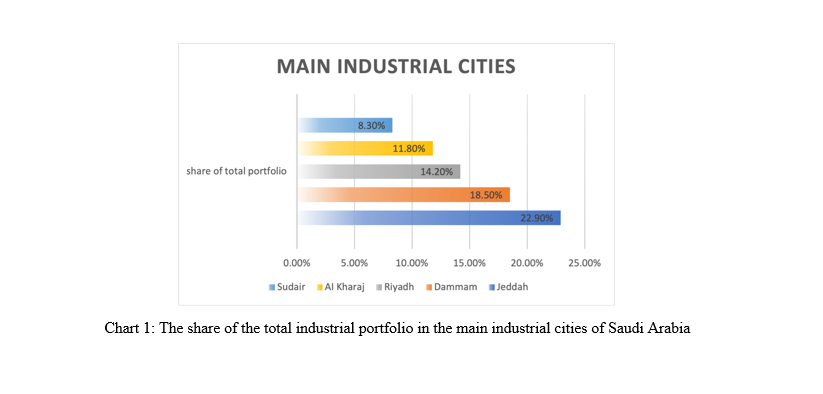

Key industrial cities such as Jeddah, Dammam, Riyadh, AI Kharaj, and Sudair are leading the way in industrial development, each holding significant shares of the total industrial portfolio (chart 1). These cities are becoming increasingly attractive destinations for investors looking to capitalize on the growing industrial sector.

Labor market

In the labor market, the Saudi economy added over one million jobs in 2023, primarily in the private sector, driving the unemployment rate down to historic lows. The extension of the expatriate fee waiver is crucial in supporting this trend, as it reduces financial burdens on companies, enabling them to expand their workforce. Additionally, the rapid rise in rents, partly due to an influx of expatriate workers, underscores the ongoing demand for foreign labor. Policies like the fee waiver ensure businesses can continue to attract and retain the necessary talent to sustain growth.

Conclusion

As Saudi Arabia faces a fiscal deficit due to declining oil revenues and increased spending, policies like the expatriate fee waiver are crucial for stabilizing the industrial sector by reducing costs and maintaining competitiveness. By alleviating the financial burden associated with hiring foreign workers, the Saudi government is directly enhancing the competitiveness and expansion of its industrial sector. For investors and business owners, this is an opportune moment to engage with one of the fastest-growing industrial markets in the Middle East.

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE). Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in China (including the Hong Kong SAR), Indonesia, Singapore, Malaysia, Mongolia, Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to Middle East Briefing’s content products, please click here. For support with establishing a business in the Middle East or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com.

- Previous Article How to Open a Bank Account in the UAE

- Next Article Shenzhen and Dubai Forge Stronger Financial Ties with New Cross-Border ETF Agreement