Investing in Abu Dhabi’s Healthcare Sector

Abu Dhabi is taking significant strides to bolster its healthcare sector capacity, presenting lucrative opportunities for investors. The UAE’s Federal Law on Foreign Direct Investment No. 16 for 2020 allows foreign investors to own up to 100 percent of healthcare facilities. The Department of Health – Abu Dhabi (DoH) is at the forefront of these efforts, aiming to create a sustainable and high-quality healthcare system that meets the community’s needs through strategic investment support and robust regulations.

Per market commentators, around 80 percent of healthcare facilities in Abu Dhabi are currently privately operated.

DoH’s strategic support for investors

The DoH actively guides both local and foreign investors, providing essential information and guidelines for establishing healthcare facilities. These guidelines encompass all aspects of building a healthcare facility, including design, infection control, engineering, and financial planning. By maintaining high transparency levels in the licensing system, DoH ensures that investors can make informed decisions and comply with regulatory requirements.

The DoH’s support for investors encompasses several key areas:

- Access: Ensuring that investors have the necessary access to relevant information and resources.

- Quality: Upholding high standards in healthcare services.

- Activity: Encouraging active participation in the healthcare sector.

- Investment opportunities: Identifying and promoting lucrative investment opportunities.

- Investment sustainability: Fostering long-term, sustainable investments.

- Market management: Efficiently managing the healthcare market.

- Value for money: Ensuring that investments deliver value.

- Patient experience: Enhancing the overall patient experience in healthcare facilities.

Facility type rules and regulations

Healthcare facilities in Abu Dhabi with 100 percent foreign ownership must adhere to specific rules and regulations, as outlined in the Healthcare Capacity Master Plan:

- General Hospital: Must have a capacity of at least 50 beds.

- Specialized Hospital: Must have a capacity of at least 50 beds.

- Rehabilitation Hospital: Must have a capacity of at least 50 beds.

- Medical Center: Should focus on rare or undersupplied specialties.

- One Day Surgery Center: Should focus on rare or undersupplied specialties.

- Specialized Clinic: Should focus on rare or undersupplied specialties.

- General Clinic: Includes hotel clinics, schools of foreign communities, and clinics for major construction companies.

Abu Dhabi Healthcare Capacity Master Plan (HCMP)

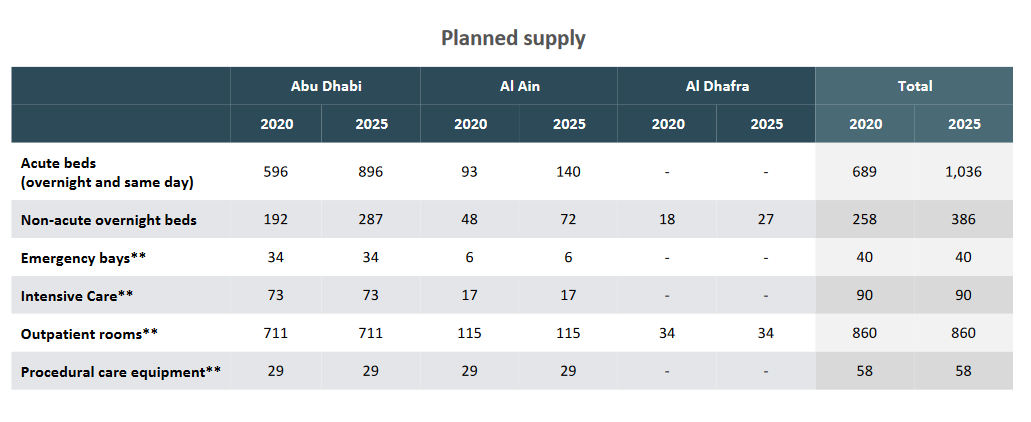

The DoH launched an updated version of the Abu Dhabi Healthcare Capacity Master Plan (HCMP) in 2020 (see here), serving as a vital reference for investors. The HCMP outlines the current and future market needs of Abu Dhabi’s healthcare sector, providing the latest data on supply and demand, as well as identifying gaps in healthcare services across Abu Dhabi, Al Ain, and Al Dhafra. The plan forecasts healthcare service and professional needs until 2035, helping investors to align their projects with future demands. The plan identifies the medical specialties and facilities that will be in demand in the Abu Dabi Emirate’s healthcare sector over the coming years, including primary care, emergency care, specialist outpatient care, acute overnight care, acute same day care, intensive care, non-acute care and long-term care, mental healthcare, women’s healthcare, diagnostic care, and clinical workforce targeting capacity in orthopedics, ENT, urology, gynecology, pediatrics, and psychiatry.

Source: Abu Dhabi Healthcare Capacity Master Plan

Planned supply in the above table refers to the additional healthcare capacity projected to become available by 2020 and 2025, as indicated by the Abu Dhabi 2018 Healthcare Facility Survey and Health Facility Licensing data. Business rules have been applied to the licensing data to estimate the likelihood of facilities being commissioned based on their completion stage. These rules are as follows:

- Facilities under 40 percent completion are not included in the planned bed count.

- Facilities over 40 percent completion will commission 50 percent of their licensed beds by 2020 and 75 percent by 2025.

Conclusion

Abu Dhabi’s healthcare sector presents a dynamic and promising investment landscape. The DoH’s commitment to transparency, comprehensive guidelines, and strategic support ensures that investors can effectively navigate the market and contribute to the development of a robust healthcare system. By aligning investments with the HCMP, investors can meet the growing healthcare needs of the Emirate and secure long-term, sustainable returns.

About Us

Middle East Briefing is one of five regional publications under the Asia Briefing brand. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Dubai (UAE), China, India, Vietnam, Singapore, Indonesia, Italy, Germany, and USA. We also have partner firms in Malaysia, Bangladesh, the Philippines, Thailand, and Australia.

For support with establishing a business in the Middle East, or for assistance in analyzing and entering markets elsewhere in Asia, please contact us at dubai@dezshira.com or visit us at www.dezshira.com. To subscribe for content products from the Middle East Briefing, please click here.