Getting Regionally Prepared For The Middle East’s New Tax Regimes

Sweeping changes are taking place amongst the Gulf Cooperation Council members that will significantly impact Foreign Investors

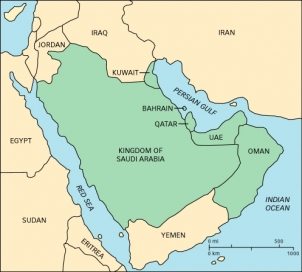

In the Middle East’s rapidly evolving business investment environment, a transformative digital tax wave is sweeping through Saudi Arabia and the Gulf Cooperation Council (GCC) region, which also brings changes to Bahrain, Kuwait, Oman, Qatar and the UAE. Foreign investors should take note of these dynamics as they affect nearly all aspects of contemporary trade and investment.

It beings into play a comprehensive transformation that impacts every facet of business operations, with a particular emphasis on compliance.

As nations and economies progress, the necessity of a streamlined, transparent, and efficient tax and compliance system becomes an imperative business requirement. This trend is a global phenomenon, with major economies increasingly embracing e-invoicing and digitised tax systems.

The operational efficiencies afforded by digital solutions enable businesses to manage their finances with greater accuracy, minimise errors, ensure real-time compliance, and save substantial financial resources, while simplifying the audit process. It also assists businesses spot any untoward figures – such as unusual stock inventory changes and so on.

The GCC Position

Regional governments and businesses are at the forefront of this transformative journey. The recent implementation of tax mandates in Saudi Arabia, with the guidelines of the Zakat, Tax and Customs Authority (ZATCA), plans for further integration of similar tax laws in other GCC countries, underscores the increasing demand and potential for digital solutions, and especially around highly-governed areas such as tax and compliance.

This now goes beyond passive observation; the industry is an active participant and facilitator, aligning with the GCC’s cloud-first policy, while supporting the digitisation of the financial sector. Offering comprehensive solutions that bridge the technology adoption gap, including products for digital payments, finance process automation, and tax and compliance digitisation, the tax services industry is pivotal in ushering businesses into a digital era.

As regional mandates increasingly reflect the progress of its regional digital transformation, there is a clear momentum toward integrating technology into tax and compliance systems. Businesses, especially those operating in regions where e-invoicing is already established, must adapt and cultivate tech-savvy approaches.

Embracing tools such as VAT Filing Reconciliation and Assistance and Accounts Payable Automation has now become crucial to ensure efficient, accurate tax operations and compliance.

The GCC Tax Vision

The overall vision for the GCC is aligned with Saudi Arabia’s Vision 2030 state development programme. Recognising Riyadh as a pivotal player in global digital transformation, the financial services industry is strategically investing in cloud-based products tailored to local needs, ensuring businesses comply with regional regulations. This focus aims to empower companies to fully exploit the potential of digitisation.

Reconfiguring Your Business

But why do CFOs and CIOs along need to consider these new solutions? The answer lies in the provision of enterprise-grade features designed to tackle challenges such as unstable connectivity and device configuration. The industry’s tech and support teams are equipped to offer nuanced, unique solutions, including expertise in major enterprise resource planners (ERPs), proactive error alerts, and customized engineering solutions.

Moving beyond accounting integration support, digital services offer customer care packaged solutions after businesses go ‘digitally live’ on their platform, ensuring a seamless transition and continuous support. This serves to eventually reduce the total cost of ownership of the project as opposed to implementing with in-house/ third-party vendors.

In cloud computing, businesses are experiencing accelerated transformation, cost efficiency, and resource optimization by transitioning to the cloud. The motivation to do so lies beyond cost reduction and operational efficiencies; it encompasses scalability, flexibility, and the capacity to adapt to evolving needs – without substantial new investments.

The industry, positioning itself not just as a service provider but as a collaborative partner in this journey, ensures that businesses not only navigate this landscape but are empowered to harness its full potential.

Pioneering Digitalisation: The Saudi Arabian Benchmark

Saudi businesses are leading the charge in cloud adoption, driving efficiency, transparency, and economic growth. Each step taken and solution offered is strategically aimed at transforming this vision into a reality, paving the way for a Saudi Arabia that is not merely digitally enabled but also a global benchmark in digital innovation and efficiency.

Industry stakeholders aren’t merely riding the wave of digital transformation; they are actively steering it, shaping a future where technology and compliance converge to create a landscape marked by innovation, efficiency, and sustainable growth.

In conclusion, the digital transformation underway in the GCC region is not merely a trend but a pivotal shift defining the future of business operations. The tax services industry, through its strategic initiatives, collaborative efforts with governments, and commitment to technological excellence, emerges as a driving force behind this transformative journey.

As businesses navigate the intricate landscape of compliance and innovation, complaint tech solutions providers remain trusted partners, facilitating a seamless transition into a future where the intersection of technology and compliance sets the stage for unprecedented growth and prosperity in the Middle East.